Page 6 - MEOG Week 28 2022

P. 6

MEOG PIPELINES & TRANSPORT MEOG

Iraq struggles to expand Gulf export capacity

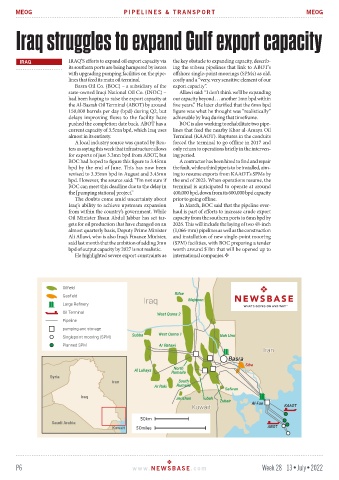

IRAQ IRAQ’S efforts to expand oil export capacity via the key obstacle to expanding capacity, describ-

its southern ports are being hampered by issues ing the subsea pipelines that link to ABOT’s

with upgrading pumping facilities on the pipe- offshore single-point moorings (SPMs) as old,

lines that feed its main oil terminal. costly and a “very, very sensitive element of our

Basra Oil Co. (BOC) – a subsidiary of the export capacity”.

state-owned Iraqi National Oil Co. (INOC) – Allawi said: “I don’t think we’ll be expanding

had been hoping to raise the export capacity at our capacity beyond … another 1mn bpd within

the Al-Basrah Oil Terminal (ABOT) by around five years.” He later clarified that the 6mn bpd

150,000 barrels per day (bpd) during Q2, but figure was what he thought was “realistically”

delays improving flows to the facility have achievable by Iraq during that timeframe.

pushed the completion date back. ABOT has a BOC is also working to rehabilitate two pipe-

current capacity of 3.5mn bpd, which Iraq uses lines that feed the nearby Khor al-Amaya Oil

almost in its entirety. Terminal (KAAOT). Ruptures in the conduits

A local industry source was quoted by Reu- forced the terminal to go offline in 2017 and

ters as saying this week that infrastructure allows only return to operations briefly in the interven-

for exports of just 3.3mn bpd from ABOT, but ing period.

BOC had hoped to figure this figure to 3.45mn A contractor has been hired to find and repair

bpd by the end of June. This has now been the fault, while a third pipe is to be installed, aim-

revised to 3.35mn bpd in August and 3.45mn ing to resume exports from KAAOT’s SPMs by

bpd. However, the source said: “I’m not sure if the end of 2023. When operations resume, the

BOC can meet this deadline due to the delay in terminal is anticipated to operate at around

the [pumping stations] project.” 400,000 bpd, down from its 600,000 bpd capacity

The doubts come amid uncertainty about prior to going offline.

Iraq’s ability to achieve upstream expansion In March, BOC said that the pipeline over-

from within the country’s government. While haul is part of efforts to increase crude export

Oil Minister Ihsan Abdul Jabbar has set tar- capacity from the southern ports to 6mn bpd by

gets for oil production that have changed on an 2026. This will include the laying of two 48-inch

almost quarterly basis, Deputy Prime Minister (1,066-mm) pipelines as well as the construction

Ali Allawi, who is also Iraq’s Finance Minister, and installation of new single-point mooring

said last month that the ambition of adding 3mn (SPM) facilities, with BOC preparing a tender

bpd of output capacity by 2027 is not realistic. worth around $1bn that will be opened up to

He highlighted severe export constraints as international companies.

P6 www. NEWSBASE .com Week 28 13•July•2022