Page 10 - FSUOGM Week 42 2022

P. 10

FSUOGM PERFORMANCE FSUOGM

European gas prices continue to fall

amid warm weather and ample LNG

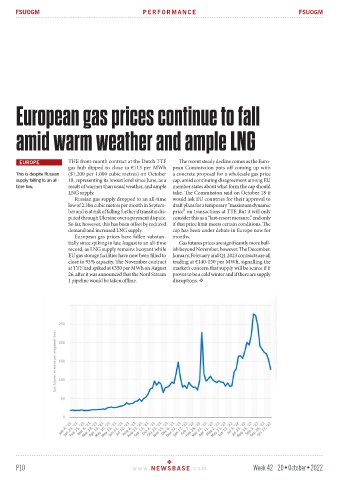

EUROPE THE front-month contract at the Dutch TTF The recent steady decline comes as the Euro-

gas hub dipped to close to €113 per MWh pean Commission puts off coming up with

This is despite Russian ($1,200 per 1,000 cubic metres) on October a concrete proposal for a wholesale gas price

supply falling to an all- 18, representing its lowest level since June, as a cap, amid continuing disagreement among EU

time low. result of warmer than usual weather, and ample member states about what form the cap should

LNG supply. take. The Commission said on October 18 it

Russian gas supply dropped to an all-time would ask EU countries for their approval to

low of 2.3bn cubic metres per month in Septem- draft plans for a temporary “maximum dynamic

ber and is at risk of falling further if transit is dis- price” on transactions at TTF. But it will only

puted through Ukraine over a payment dispute. consider this as a “last-resort measure,” and only

So far, however, this has been offset by reduced if that price limit meets certain conditions. The

demand and increased LNG supply. cap has been under debate in Europe now for

European gas prices have fallen substan- months.

tially since spiking in late August to an all-time Gas futures prices are significantly more bull-

record, as LNG supply remains buoyant while ish beyond November, however. The December,

EU gas storage facilities have now been filled to January, February and Q1 2023 contracts are all

close to 93% capacity. The November contract trading at €140-150 per MWh, signalling the

at TTF had spiked at €350 per MWh on August market’s concern that supply will be scarce if it

26, after it was announced that the Nord Stream proves to be a cold winter and if there are supply

1 pipeline would be taken offline. disruptions.

P10 www. NEWSBASE .com Week 42 20•October•2022