Page 5 - MEOG Week 24 2021

P. 5

MEOG COMMENTARY MEOG

He said that discussions are focusing on “tim-

ing and all other details”, adding: “We are work-

ing to increase production gradually.”

Downturn

In response to the outbreak of the coronavirus

(COVID-19) pandemic, Baghdad called on

IOCs to cut capital expenditures and reduce

output from certain southern fields by 350,000

bpd, while BOC, which is responsible for the

southern region, was expected to reduce output

by 300,000 bpd in order to help Iraq comply with

OPEC+ reduction targets.

Elyaseri told Platts: “Rumaila Operating

Organisation (ROO) and BP have responded to

the ministry’s request to reduce capex by 30%,

coupled obviously with the OPEC cuts and the

low oil price, and this impacts activity sets.”

He added that “aside from the reduction in

capex, some activities have been postponed

(for example the produced water re-injection

project), while restricted access to the field and

global travel due to COVID-19 have impacted bidding rounds feature per barrel fees ranging

the movement of people and materials.” from $1.15 (Lukoil at West Qurna 2) to $5.50

Rumaila managed to produce around 25% of (GazpromNeft at Badra).

its oil in place (OIP) before water injection was However, Elyaseri told Platts that he was not

required. “aware of any discussions taking place around

Its Qarmat Ali water treatment plant pro- the terms of the technical service contract”.

vides around 500,000 bpd of water and the

capacity could be doubled to avoid reliance on Renegotiations

the long-delayed Common Seawater Supply In early June, though, Iraq’s Cabinet announced

Facility (CSSF). With water-flooding planned to plans to conduct a study to review the country’s

boost output, though, estimates have suggested oil and gas exploration and transport contracts

that the field’s water requirements could reach with foreign companies following calls from

8mn bpd. MPs to amend terms.

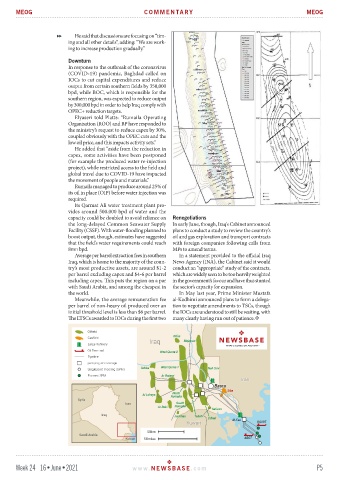

Average per barrel extraction fees in southern In a statement provided to the official Iraq

Iraq, which is home to the majority of the coun- News Agency (INA), the Cabinet said it would

try’s most productive assets, are around $1-2 conduct an “appropriate” study of the contracts,

per barrel excluding capex and $4-6 per barrel which are widely seen to be too heavily weighted

including capex. This puts the region on a par in the government’s favour and have thus stunted

with Saudi Arabia, and among the cheapest in the sector’s capacity for expansion.

the world. In May last year, Prime Minister Mustafa

Meanwhile, the average remuneration fee al-Kadhimi announced plans to form a delega-

per barrel of non-heavy oil produced over an tion to negotiate amendments to TSCs, though

initial threshold level is less than $6 per barrel. the IOCs are understood to still be waiting, with

The LTSCs awarded to IOCs during the first two many clearly having run out of patience.

Week 24 16•June•2021 www. NEWSBASE .com P5