Page 9 - MEOG Week 24 2021

P. 9

MEOG FINANCE & INVESTMENT MEOG

Aramco maintains finance push

SAUDI ARABIA SAUDI Aramco last week raised $6bn via its maintenance and for making rate payments for

first dollar-denominated sukuk and is reported crude transferred through the extensive pipeline

to have hired Morgan Stanley to advise on an network.

upcoming asset monetisation deal. While talks are understood to be prelim-

The mainly state-owned company sold bonds inary at the moment, Middle East Oil & Gas

in three tranches, attracting orders with a com- (MEOG) understands from company sources

bined value of more than $60bn as it surpassed that the success of the oil conduit deal has given

the reported sukuk target of $5bn. The funds are Aramco confidence to “copy & paste” the same

likely to be used in part to cover a portion of Ara- lease-out-and-lease-back formula used before

mco’s upcoming quarterly $18.75bn payment. on the gas pipelines. The sources said that the

$1bn of three-year bonds were sold at 65 basis company is keen to emulate or improve upon the

points (bps) over US Treasuries (UST), a $2bn results achieved by Abu Dhabi National Oil Co.

five-year tranche was sold at 85 bps over UST (ADNOC), which leased 49% stakes in ADNOC

with $3bn of 10-year bonds fetching 120 bps over Oil Pipelines and ADNOC Gas Pipelines for

UST, significantly below guidance on account of over the past two years for $4.9bn and $10.1bn

the high demand. respectively.

Aramco hired 13 banks to lead the sukuk: Aramco’s Master Gas System network has a

Alinma Invest, Al Rajhi Capital, BNP Paribas, total current capacity of 9.6bn cubic feet (272mn

Citi, First Abu Dhabi Bank, Goldman Sachs cubic metres) per day following an expansion in

International, HSBC, JPMorgan, Morgan Stan- 2017 and 2018.

ley, NCB Capital, Riyad Capital, SMBC Nikko An additional expansion phase was due to be

and Standard Chartered. completed in 2019, taking total capacity to 12.5

bcf (354 mcm) per day through an additional

Gas deal adviser 1,600 km of pipelines to increase gas supplies to

Meanwhile, Bloomberg quoted sources familiar the Red Sea coast.

with proceedings as saying that Morgan Stan- However, articles on the Aramco website

ley had been appointed as the lead adviser on a in October 2020 said that the “next phase”

deal to monetise its gas pipeline infrastructure remained under construction, noting the addi-

in much the same way it did with its oil pipeline tion of 821 km of new pipelines, just over half

business earlier this year. the amount expected when it released its 2017

In April, the company successfully closed a annual report. According to Aramco, “the total

$12.4bn deal for a consortium led by EIG Global length [of] pipeline in service, ready for com-

Partners to acquire a 49% stake in Aramco Oil missioning or decommissioned is 3,850 km, and

Pipelines Co. (AOPC) for a duration of 25 years. pipelines under construction totals an additional

Under the deal, the Saudi firm will be liable for all 1,075 km”.

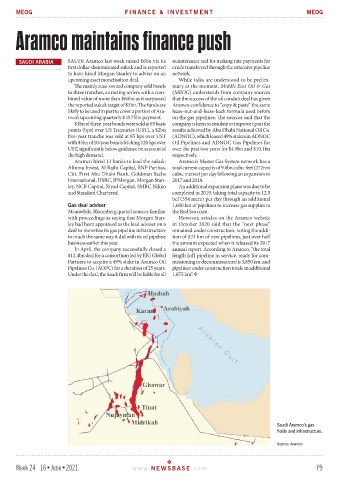

Saudi Aramco’s gas

fields and infrastructure.

Source: Aramco

Week 24 16•June•2021 www. NEWSBASE .com P9