Page 5 - MEOG Week 37 2021

P. 5

MEOG COMMENTARY MEOG

day following expansion in 2017 and 2018. has begun preliminary talks with potential

The company achieved a single-day gas pro- investors including large commodity traders as

duction record of 10.7 bcf (303 mcm) just over it looks for funding and tight gas expertise.

a year ago. However, such a move would need the

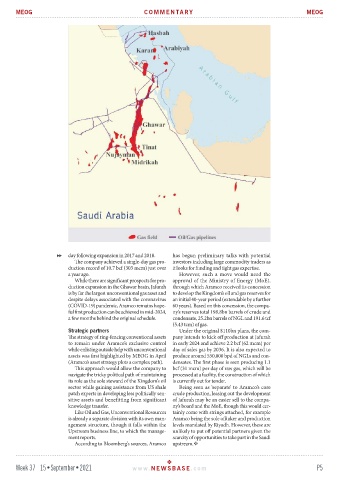

While there are significant prospects for pro- approval of the Ministry of Energy (MoE),

duction expansion in the Ghawar basin, Jafurah through which Aramco received its concession

is by far the largest unconventional gas asset and to develop the Kingdom’s oil and gas reserves for

despite delays associated with the coronavirus an initial 40-year period (extendable by a further

(COVID-19) pandemic, Aramco remains hope- 60 years). Based on this concession, the compa-

ful first production can be achieved in mid-2024, ny’s reserves total 198.8bn barrels of crude and

a few months behind the original schedule. condensate, 25.2bn barrels of NGL and 191.6 tcf

(5.43 tcm) of gas.

Strategic partners Under the original $110bn plans, the com-

The strategy of ring-fencing conventional assets pany intends to kick off production at Jafurah

to remain under Aramco’s exclusive control in early 2024 and achieve 2.2 bcf (62 mcm) per

while enlisting outside help with unconventional day of sales gas by 2036. It is also expected to

assets was first highlighted by MEOG in April produce around 550,000 bpd of NGLs and con-

(Aramco’s asset strategy plots a complex path). densates. The first phase is seen producing 1.1

This approach would allow the company to bcf (31 mcm) per day of raw gas, which will be

navigate the tricky political path of maintaining processed at a facility, the construction of which

its role as the sole steward of the Kingdom’s oil is currently out for tender.

sector while gaining assistance from US shale Being seen as ‘separate’ to Aramco’s core

patch experts in developing less politically sen- crude production, leasing out the development

sitive assets and benefitting from significant of Jafurah may be an easier sell to the compa-

knowledge transfer. ny’s board and the MoE, though this would cer-

Like Oil and Gas, Unconventional Resources tainly come with strings attached, for example

is already a separate division with its own man- Aramco being the sole offtaker and production

agement structure, though it falls within the levels mandated by Riyadh. However, these are

Upstream business line, to which the manage- unlikely to put off potential partners given the

ment reports. scarcity of opportunities to take part in the Saudi

According to Bloomberg’s sources, Aramco upstream.

Week 37 15•September•2021 www. NEWSBASE .com P5