Page 7 - EurOil Week 29 2022

P. 7

EurOil COMMENTARY EurOil

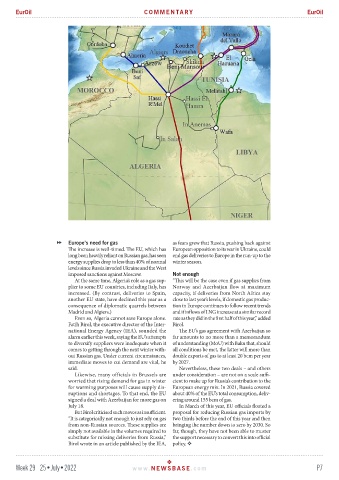

Europe’s need for gas as fears grew that Russia, pushing back against

The increase is well-timed. The EU, which has European opposition to its war in Ukraine, could

long been heavily reliant on Russian gas, has seen end gas deliveries to Europe in the run-up to the

energy supplies drop to less than 40% of normal winter season.

levels since Russia invaded Ukraine and the West

imposed sanctions against Moscow. Not enough

At the same time, Algeria’s role as a gas sup- “This will be the case even if gas supplies from

plier to some EU countries, including Italy, has Norway and Azerbaijan flow at maximum

increased. (By contrast, deliveries to Spain, capacity, if deliveries from North Africa stay

another EU state, have declined this year as a close to last year’s levels, if domestic gas produc-

consequence of diplomatic quarrels between tion in Europe continues to follow recent trends

Madrid and Algiers.) and if inflows of LNG increase at a similar record

Even so, Algeria cannot save Europe alone. rate as they did in the first half of this year,” added

Fatih Birol, the executive director of the Inter- Birol.

national Energy Agency (IEA), sounded the The EU’s gas agreement with Azerbaijan so

alarm earlier this week, saying the EU’s attempts far amounts to no more than a memorandum

to diversify suppliers were inadequate when it of understanding (MoU) with Baku that, should

comes to getting through the next winter with- all conditions be met, the latter will more than

out Russian gas. Under current circumstances, double exports of gas to at least 20 bcm per year

immediate moves to cut demand are vital, he by 2027.

said. Nevertheless, these two deals – and others

Likewise, many officials in Brussels are under consideration – are not on a scale suffi-

worried that rising demand for gas in winter cient to make up for Russia’s contribution to the

for warming purposes will cause supply dis- European energy mix. In 2021, Russia covered

ruptions and shortages. To that end, the EU about 40% of the EU’s total consumption, deliv-

signed a deal with Azerbaijan for more gas on ering around 155 bcm of gas.

July 18. In March of this year, EU officials floated a

But Birol criticised such moves as insufficient. proposal for reducing Russian gas imports by

“It is categorically not enough to just rely on gas two thirds before the end of this year and then

from non-Russian sources. These supplies are bringing the number down to zero by 2030. So

simply not available in the volumes required to far, though, they have not been able to muster

substitute for missing deliveries from Russia,” the support necessary to convert this into official

Birol wrote in an article published by the IEA, policy.

Week 29 25•July•2022 www. NEWSBASE .com P7