Page 4 - MEOG Week 12 2021

P. 4

MEOG COMMENTARY MEOG

Aramco posts massive

profit despite Covid

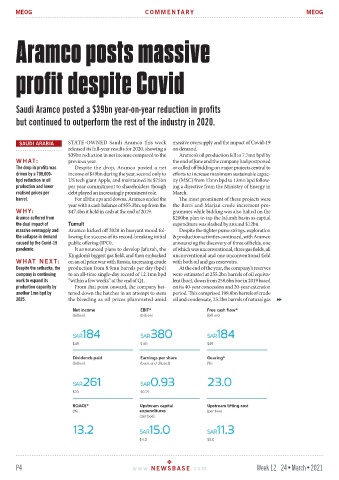

Saudi Aramco posted a $39bn year-on-year reduction in profits

but continued to outperform the rest of the industry in 2020.

SAUDI ARABIA STATE-OWNED Saudi Aramco this week massive oversupply and the impact of Covid-19

released its full-year results for 2020, showing a on demand.

$39bn reduction in net income compared to the Aramco’s oil production fell to 7.7mn bpd by

WHAT: previous year. the end of June and the company had postponed

The drop in profits was Despite the drop, Aramco posted a net or called off bidding on major projects central to

driven by a 700,000- income of $49bn during the year, second only to efforts to increase maximum sustainable capac-

bpd reduction in oil US tech giant Apple, and maintained its $75bn ity (MSC) from 12mn bpd to 13mn bpd follow-

production and lower per year commitment to shareholders though ing a directive from the Ministry of Energy in

realised prices per debt played an increasingly prominent role. March.

barrel. For all the ups and downs, Aramco ended the The most prominent of these projects were

year with a cash balance of $55.3bn, up from the the Berri and Marjan crude increment pro-

WHY: $47.4bn it held in cash at the end of 2019. grammes while bidding was also halted on the

Aramco suffered from $200bn plan to tap the Jafurah basin as capital

the dual impact of Tumult expenditure was slashed by around $12bn.

massive oversupply and Aramco kicked off 2020 in buoyant mood fol- Despite the tighter purse strings, exploration

the collapse in demand lowing the success of its record-breaking initial & production activities continued, with Aramco

caused by the Covid-19 public offering (IPO). announcing the discovery of three oilfields, one

pandemic. It announced plans to develop Jafurah, the of which was unconventional, three gas fields, all

Kingdom’s biggest gas field, and then embarked unconventional and one unconventional field

WHAT NEXT: on an oil price war with Russia, increasing crude with both oil and gas reservoirs.

Despite the setbacks, the production from 8.9mn barrels per day (bpd) At the end of the year, the company’s reserves

company is continuing to an all-time single-day record of 12.1mn bpd were estimated at 255.2bn barrels of oil equiva-

work to expand its “within a few weeks” at the end of Q1. lent (boe), down from 258.6bn boe in 2019 based

production capacity by From that point onward, the company bat- on its 40-year concession and 20-year extension

another 1mn bpd by tened down the hatches in an attempt to stem period. This comprised 198.8bn barrels of crude

2025. the bleeding as oil prices plummeted amid oil and condensate, 25.2bn barrels of natural gas

P4 www. NEWSBASE .com Week 12 24•March•2021