Page 7 - DMEA Week 18 2022

P. 7

DMEA COMMENTARY DMEA

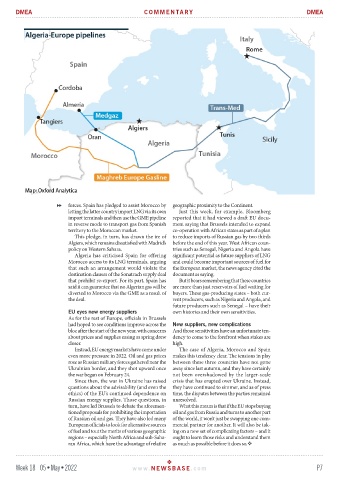

forces. Spain has pledged to assist Morocco by geographic proximity to the Continent.

letting the latter country import LNG via its own Just this week, for example, Bloomberg

import terminals and then use the GME pipeline reported that it had viewed a draft EU docu-

in reverse mode to transport gas from Spanish ment saying that Brussels intended to expand

territory to the Moroccan market. co-operation with African states as part of a plan

This pledge, in turn, has drawn the ire of to reduce imports of Russian gas by two thirds

Algiers, which remains dissatisfied with Madrid’s before the end of this year. West African coun-

policy on Western Sahara. tries such as Senegal, Nigeria and Angola have

Algeria has criticised Spain for offering significant potential as future suppliers of LNG

Morocco access to its LNG terminals, arguing and could become important sources of fuel for

that such an arrangement would violate the the European market, the news agency cited the

destination clauses of the Sonatrach supply deal document as saying.

that prohibit re-export. For its part, Spain has But it bears remembering that these countries

said it can guarantee that no Algerian gas will be are more than just reservoirs of fuel waiting for

diverted to Morocco via the GME as a result of buyers. These gas-producing states – both cur-

the deal. rent producers, such as Nigeria and Angola, and

future producers such as Senegal – have their

EU eyes new energy suppliers own histories and their own sensitivities.

As for the rest of Europe, officials in Brussels

had hoped to see conditions improve across the New suppliers, new complications

bloc after the start of the new year, with concerns And those sensitivities have an unfortunate ten-

about prices and supplies easing as spring drew dency to come to the forefront when stakes are

closer. high.

Instead, EU energy markets have come under The case of Algeria, Morocco and Spain

even more pressure in 2022. Oil and gas prices makes this tendency clear. The tensions in play

rose as Russian military forces gathered near the between these three countries have not gone

Ukrainian border, and they shot upward once away since last autumn, and they have certainly

the war began on February 24. not been overshadowed by the larger-scale

Since then, the war in Ukraine has raised crisis that has erupted over Ukraine. Instead,

questions about the advisability (and even the they have continued to simmer, and as of press

ethics) of the EU’s continued dependence on time, the disputes between the parties remained

Russian energy supplies. Those questions, in unresolved.

turn, have led Brussels to debate the aforemen- What this means is that if the EU stops buying

tioned proposals for prohibiting the importation oil and gas from Russia and turns to another part

of Russian oil and gas. They have also led many of the world, it won’t just be swapping one com-

European officials to look for alternative sources mercial partner for another. It will also be tak-

of fuel and tout the merits of various geographic ing on a new set of complicating factors – and it

regions – especially North Africa and sub-Saha- ought to learn those risks and understand them

ran Africa, which have the advantage of relative as much as possible before it does so.

Week 18 05•May•2022 www. NEWSBASE .com P7