Page 4 - MEOG Week 16 2021

P. 4

MEOG COMMENTARY MEOG

Iraq seeks buyer for

ExxonMobil’s stake

in West Qurna-1

Iraq’s Ministry of Oil last week said that it is holding talks with US firms for the

potential purchase of ExxonMobil’s stake in the supergiant West Qurna-1 oilfield.

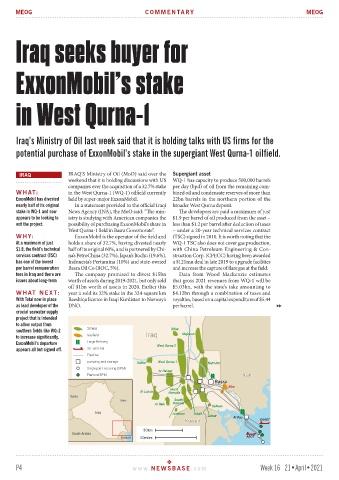

IRAQ IRAQ’S Ministry of Oil (MoO) said over the Supergiant asset

weekend that it is holding discussions with US WQ-1 has capacity to produce 500,000 barrels

companies over the acquisition of a 32.7% stake per day (bpd) of oil from the remaining com-

WHAT: in the West Qurna-1 (WQ-1) oilfield currently bined oil and condensate reserves of more than

ExxonMobil has divested held by super-major ExxonMobil. 22bn barrels in the northern portion of the

nearly half of its original In a statement provided to the official Iraqi broader West Qurna deposit.

stake in WQ-1 and now News Agency (INA), the MoO said: “The min- The developers are paid a maximum of just

appears to be looking to istry is studying with American companies the $1.9 per barrel of oil produced from the asset –

exit the project. possibility of purchasing ExxonMobil’s share in less than $1.2 per barrel after deduction of taxes

West Qurna-1 field in Basra Governorate”. – under a 20-year technical services contract

WHY: ExxonMobil is the operator of the field and (TSC) signed in 2010. It is worth noting that the

At a maximum of just holds a share of 32.7%, having divested nearly WQ-1 TSC also does not cover gas production,

$1.9, the field’s technical half of its original 60%, and is partnered by Chi- with China Petroleum Engineering & Con-

services contract (TSC) na’s PetroChina (32.7%), Japan’s Itochu (19.6%), struction Corp. (CPECC) having been awarded

has one of the lowest Indonesia’s Pertamina (10%) and state-owned a $121mn deal in late 2019 to upgrade facilities

per barrel remuneration Basra Oil Co (BOC, 5%). and increase the capture of flare gas at the field.

fees in Iraq and there are The company promised to divest $15bn Data from Wood Mackenzie estimates

issues about long-term worth of assets during 2019-2021, but only sold that gross 2021 revenues from WQ-1 will be

off $1bn worth of assets in 2020. Earlier this $5.03bn, with the state’s take amounting to

WHAT NEXT: year it sold its 32% stake in the 324-square km $4.12bn through a combination of taxes and

With Total now in place Baeshiqa licence in Iraqi Kurdistan to Norway’s royalties, based on a capital expenditure of $5.44

as lead developer of the DNO. per barrel.

crucial seawater supply

project that is intended

to allow output from

southern fields like WQ-2

to increase significantly,

ExxonMobil’s departure

appears all but signed off.

P4 www. NEWSBASE .com Week 16 21•April•2021