Page 5 - FSUOGM Week 40 2021

P. 5

FSUOGM COMMENTARY FSUOGM

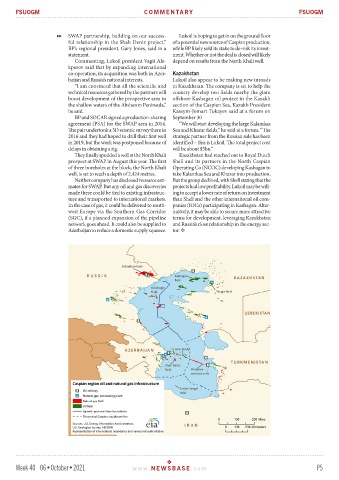

SWAP partnership, building on our success- Lukoil is hoping to get in on the ground floor

ful relationship in the Shah Deniz project,” of a potential new source of Caspian production,

BP’s regional president, Gary Jones, said in a while BP likely sold its stake to de-risk its invest-

statement. ment. Whether or not the deal is closed will likely

Commenting, Lukoil president Vagit Ale- depend on results from the North Khali well.

kperov said that by expanding international

co-operation, its acquisition was both in Azer- Kazakhstan

baijan and Russia’s national interests. Lukoil also appear to be making new inroads

“I am convinced that all the scientific and in Kazakhstan. The company is set to help the

technical resources gathered by the partners will country develop two fields nearby the giant

boost development of the prospective area in offshore Kashagan oil project in the Kazakh

the shallow waters of the Absheron Peninsula,” section of the Caspian Sea, Kazakh President

he said. Kassym-Jomart Tokayev said at a forum on

BP and SOCAR signed a production-sharing September 30

agreement (PSA) for the SWAP area in 2014. “We will start developing the large Kalamkas

The pair undertook a 3D seismic survey there in Sea and Khazar fields,” he said at a forum. “The

2016 and they had hoped to drill their first well strategic partner from the Russian side has been

in 2019, but the work was postponed because of identified – this is Lukoil. The total project cost

delays in obtaining a rig. will be about $5bn.”

They finally spudded a well at the North Khali Kazakhstan had reached out to Royal Dutch

prospect at SWAP in August this year. The first Shell and its partners in the North Caspian

of three boreholes at the block, the North Khali Operating Co (NCOC) developing Kashagan to

well, is set to reach a depth of 2,424 metres. take Kalamkas Sea and Khazar into production.

Neither company has disclosed resource esti- But the group declined, with Shell stating that the

mates for SWAP. But any oil and gas discoveries projects had low profitability. Lukoil may be will-

made there could be tied to existing infrastruc- ing to accept a lower rate of return on investment

ture and transported to international markets. than Shell and the other international oil com-

In the case of gas, it could be delivered to south- panies (IOCs) participating in Kashagan. Alter-

west Europe via the Southern Gas Corridor natively, it may be able to secure more attractive

(SGC), if a planned expansion of the pipeline terms for development, leveraging Kazakhstan

network goes ahead. It could also be supplied to and Russia’s close relationship in the energy sec-

Azerbaijan to reduce a domestic supply squeeze. tor.

Week 40 06•October•2021 www. NEWSBASE .com P5