Page 14 - C:\Users\Chris Patches\My ShareSync\Virtual Events\2024 - TMT Consumer\Book\Flip Output\

P. 14

Communication

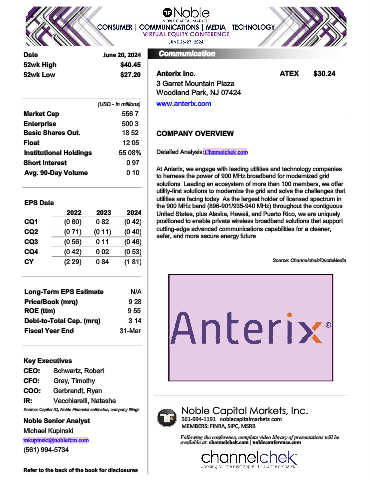

Date June 20, 2024 Communication Services

52wk High $40.45

52wk Low $27.20 Anterix Inc. ATEX $30.24

3 Garret Mountain Plaza

Woodland Park, NJ 07424

(USD - in millions) www.anterix.com

Market Cap 556.7

Enterprise 500.3

Basic Shares Out. 18.52 COMPANY OVERVIEW

Float 12.05

Institutional Holdings 55.08% Detailed Analysis:Channelchek.com

Short Interest 0.97

Avg. 90-Day Volume 0.10 At Anterix, we engage with leading utilities and technology companies

to harness the power of 900 MHz broadband for modernized grid

solutions. Leading an ecosystem of more than 100 members, we offer

utility-first solutions to modernize the grid and solve the challenges that

EPS Data utilities are facing today. As the largest holder of licensed spectrum in

the 900 MHz band (896-901/935-940 MHz) throughout the contiguous

2022 2023 2024 United States, plus Alaska, Hawaii, and Puerto Rico, we are uniquely

CQ1 (0.60) 0.82 (0.42) positioned to enable private wireless broadband solutions that support

CQ2 (0.71) (0.11) (0.40) cutting-edge advanced communications capabilities for a cleaner,

safer, and more secure energy future.

CQ3 (0.56) 0.11 (0.46)

CQ4 (0.42) 0.02 (0.53)

CY (2.29) 0.84 (1.81) Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 9.28

ROE (ttm) 9.55

Debt-to-Total Cap. (mrq) 3.14

Fiscal Year End 31-Mar

3 Garret MounWoodland ParNJ 07424

Key Executives

CEO: Schwartz, Robert

CFO: Gray, Timothy

COO: Gerbrandt, Ryan

IR: Vecchiarelli, Natasha

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Michael Kupinski MEMBERS: FINRA, SIPC, MSRB

mkupinski@noblefcm.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 994-5734

Refer to the back of the book for disclosures