Page 21 - C:\Users\Chris Patches\My ShareSync\Virtual Events\2024 - TMT Consumer\Book\Flip Output\

P. 21

Bitcoin Depot Inc.

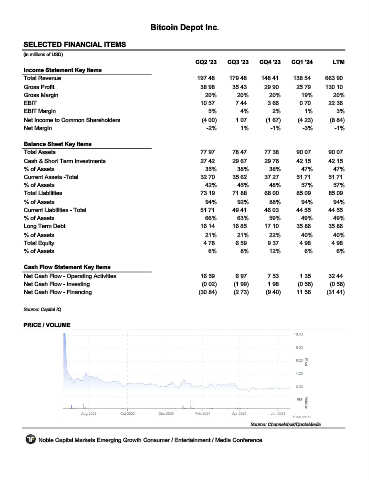

SELECTED FINANCIAL ITEMS BTM

(in millions of USD)

CQ2 '23 CQ3 '23 CQ4 '23 CQ1 '24 LTM

Income Statement Key Items

Total Revenue 197.48 179.48 148.41 138.54 663.90

Gross Profit 38.98 35.43 29.90 25.79 130.10

Gross Margin 20% 20% 20% 19% 20%

EBIT 10.57 7.44 3.66 0.70 22.36

EBIT Margin 5% 4% 2% 1% 3%

Net Income to Common Shareholders (4.00) 1.07 (1.67) (4.23) (8.84)

Net Margin -2% 1% -1% -3% -1%

Balance Sheet Key Items

Total Assets 77.97 78.47 77.38 90.07 90.07

Cash & Short Term Investments 27.42 29.67 29.76 42.15 42.15

% of Assets 35% 38% 38% 47% 47%

Current Assets -Total 32.70 35.62 37.27 51.71 51.71

% of Assets 42% 45% 48% 57% 57%

Total Liabilities 73.19 71.88 68.00 85.09 85.09

% of Assets 94% 92% 88% 94% 94%

Current Liabilities - Total 51.71 49.41 46.03 44.55 44.55

% of Assets 66% 63% 59% 49% 49%

Long Term Debt 16.14 16.85 17.10 35.86 35.86

% of Assets 21% 21% 22% 40% 40%

Total Equity 4.78 6.59 9.37 4.98 4.98

% of Assets 6% 8% 12% 6% 6%

Cash Flow Statement Key Items

Net Cash Flow - Operating Activities 16.59 6.97 7.53 1.35 32.44

Net Cash Flow - Investing (0.02) (1.99) 1.98 (0.56) (0.58)

Net Cash Flow - Financing (30.84) (2.73) (9.40) 11.56 (31.41)

Source: Capital IQ

PRICE / VOLUME

Source: Channelchek/QuoteMedia

Noble Capital Markets Emerging Growth Consumer / Entertainment / Media Conference