Page 63 - C:\Users\Troy-LapTop\Documents\Flip PDF\Millionaire Maker\

P. 63

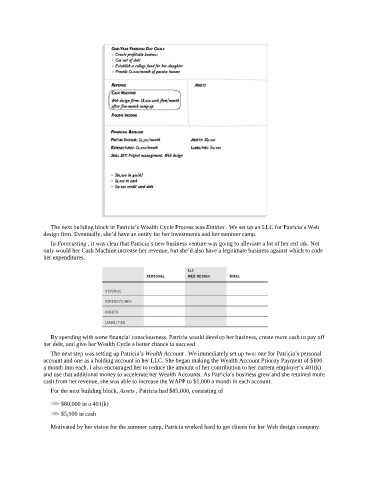

The next building block in Patricia’s Wealth Cycle Process was Entities . We set up an LLC for Patricia’s Web

design firm. Eventually, she’d have an entity for her investments and her summer camp.

In Forecasting , it was clear that Patricia’s new business venture was going to alleviate a lot of her red ink. Not

only would her Cash Machine increase her revenue, but she’d also have a legitimate business against which to code

her expenditures.

By spending with some financial consciousness, Patricia would develop her business, create more cash to pay off

her debt, and give her Wealth Cycle a better chance to succeed

The next step was setting up Patricia’s Wealth Account . We immediately set up two: one for Patricia’s personal

account and one as a holding account in her LLC. She began making the Wealth Account Priority Payment of $100

a month into each. I also encouraged her to reduce the amount of her contribution to her current employer’s 401(k)

and use that additional money to accelerate her Wealth Accounts. As Patricia’s business grew and she retained more

cash from her revenue, she was able to increase the WAPP to $1,000 a month in each account.

For the next building block, Assets , Patricia had $85,000, consisting of

$80,000 in a 401(k)

$5,000 in cash

Motivated by her vision for the summer camp, Patricia worked hard to get clients for her Web design company.