Page 121 - Minutes of meeting

P. 121

The Resilience Challenge

Innovation

Cumbria’s Innovation Activity Profile, 2014-16

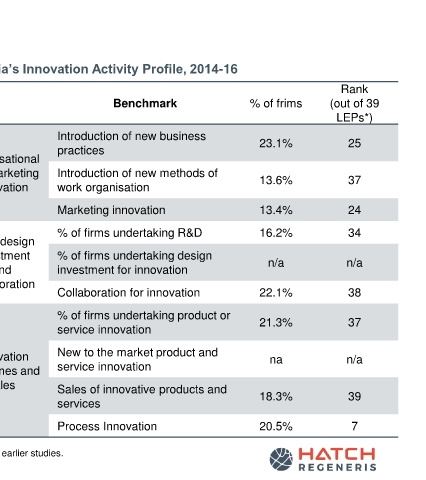

Further insight into Cumbria LEP’s performance across

different types of innovative activities is provided by Rank

the Enterprise Research Centre (2019). Ten Benchmark % of frims (out of 39

benchmarks were constructed to capture three types LEPs*)

of innovation activities. The analysis used data from Introduction of new business

the UK Innovation Survey 2017, which captures firms’ practices 23.1% 25

innovation activity between 2014-16. Organisational

and marketing Introduction of new methods of

The table illustrates that innovation activity levels in innovation work organisation 13.6% 37

Cumbria are low across all metrics. Cumbria LEP

ranks amongst the five worst performing LEPs in 4 out Marketing innovation 13.4% 24

of 8 available benchmarks. An exception is process

innovation, in which Cumbria appears to have a strong R&D, design % of firms undertaking R&D 16.2% 34

th

footing as it ranks 7 . investment % of firms undertaking design

and investment for innovation n/a n/a

Innovation active firms in Barrow include those within collaboration

the manufacturing and energy supply chains including: Collaboration for innovation 22.1% 38

▪ BAE Systems % of firms undertaking product or 21.3% 37

service innovation

▪ James Fisher Marine & Sub-Sea

Innovation New to the market product and na n/a

▪ Siemens Subsea Outcomes and service innovation

sales

▪ Forth Engineering Sales of innovative products and 18.3% 39

services

Process Innovation 20.5% 7

* The LEP geography preceding the recent consolidation was used to facilitate comparability with earlier studies.

Source: Benchmarking Local Innovation, ERC, 2019