Page 123 - Accounting Principles (A Business Perspective)

P. 123

This book is licensed under a Creative Commons Attribution 3.0 License

company debits the prepayment to the Prepaid Rent account (an asset account). The company has not yet received

benefits resulting from this expenditure. Thus, the expenditure creates an asset.

We measure rent expense similarly to insurance expense. Generally, the rental contract specifies the amount of

rent per unit of time. If the prepayment covers a three-month rental, we charge one-third of this rental to each

month. Notice that the amount charged is the same each month even though some months have more days than

other months.

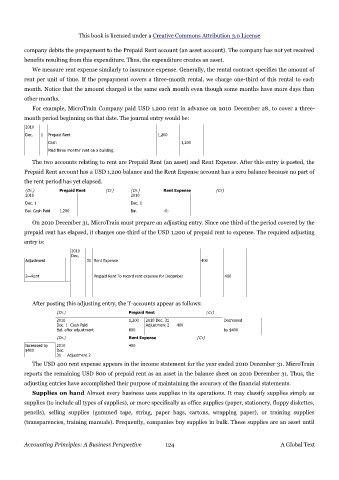

For example, MicroTrain Company paid USD 1,200 rent in advance on 2010 December 28, to cover a three-

month period beginning on that date. The journal entry would be:

2010

Dec. 1 Prepaid Rent 1,200

Cash 1,200

Paid three months' rent on a building.

The two accounts relating to rent are Prepaid Rent (an asset) and Rent Expense. After this entry is posted, the

Prepaid Rent account has a USD 1,200 balance and the Rent Expense account has a zero balance because no part of

the rent period has yet elapsed.

(Dr.) Prepaid Rent (Cr) (Dr.) Rent Expense (Cr)

2010 2010

Dec. 1 Dec. 1

Bal. Cash Paid 1,200 Bal. -0-

On 2010 December 31, MicroTrain must prepare an adjusting entry. Since one third of the period covered by the

prepaid rent has elapsed, it charges one-third of the USD 1,200 of prepaid rent to expense. The required adjusting

entry is:

2010

Dec.

Adjustment 31 Rent Expense 400

2—Rent Prepaid Rent To record rent expense for December 400

After posting this adjusting entry, the T-accounts appear as follows:

(Dr.) Prepaid Rent (Cr)

2010 1,200 2010 Dec. 31 Decreased

Dec. 1 Cash Paid Adjustment 2 400

Bal. after adjustment 800 by $400

(Dr.) Rent Expense (Cr)

Increased by 2010 400

$400 Dec.

31 Adjustment 2

The USD 400 rent expense appears in the income statement for the year ended 2010 December 31. MicroTrain

reports the remaining USD 800 of prepaid rent as an asset in the balance sheet on 2010 December 31. Thus, the

adjusting entries have accomplished their purpose of maintaining the accuracy of the financial statements.

Supplies on hand Almost every business uses supplies in its operations. It may classify supplies simply as

supplies (to include all types of supplies), or more specifically as office supplies (paper, stationery, floppy diskettes,

pencils), selling supplies (gummed tape, string, paper bags, cartons, wrapping paper), or training supplies

(transparencies, training manuals). Frequently, companies buy supplies in bulk. These supplies are an asset until

Accounting Principles: A Business Perspective 124 A Global Text