Page 124 - Accounting Principles (A Business Perspective)

P. 124

3. Adjustments for financial reporting

the company uses them. This asset may be called supplies on hand or supplies inventory. Even though these terms

indicate a prepaid expense, the firm does not use prepaid in the asset’s title.

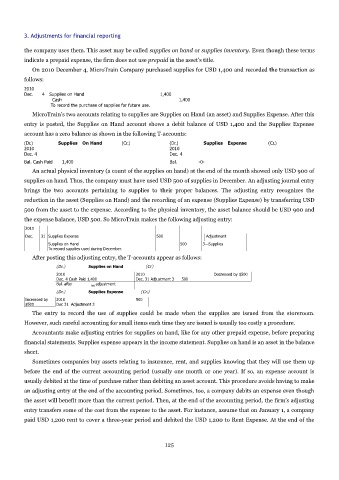

On 2010 December 4, MicroTrain Company purchased supplies for USD 1,400 and recorded the transaction as

follows:

2010

Dec. 4 Supplies on Hand 1,400

Cash 1,400

To record the purchase of supplies for future use.

MicroTrain’s two accounts relating to supplies are Supplies on Hand (an asset) and Supplies Expense. After this

entry is posted, the Supplies on Hand account shows a debit balance of USD 1,400 and the Supplies Expense

account has a zero balance as shown in the following T-accounts:

(Dr.) Supplies On Hand (Cr.) (Dr.) Supplies Expense (Cr.)

2010 2010

Dec. 4 Dec. 4

Bal. Cash Paid 1,400 Bal. -0-

An actual physical inventory (a count of the supplies on hand) at the end of the month showed only USD 900 of

supplies on hand. Thus, the company must have used USD 500 of supplies in December. An adjusting journal entry

brings the two accounts pertaining to supplies to their proper balances. The adjusting entry recognizes the

reduction in the asset (Supplies on Hand) and the recording of an expense (Supplies Expense) by transferring USD

500 from the asset to the expense. According to the physical inventory, the asset balance should be USD 900 and

the expense balance, USD 500. So MicroTrain makes the following adjusting entry:

2010

Dec. 31 Supplies Expense 500 Adjustment

Supplies on Hand 500 3—Supplies

To record supplies used during December.

After posting this adjusting entry, the T-accounts appear as follows:

(Dr.) Supplies on Hand (Cr)

2010 2010 Decreased by $500

Dec. 4 Cash Paid 1,400 Dec. 31 Adjustment 3 500

Bal. after adjustment

900

(Dr.) Supplies Expense (Cr.)

Increased by 2010 500

$500 Dec 31 Adjustment 3

The entry to record the use of supplies could be made when the supplies are issued from the storeroom.

However, such careful accounting for small items each time they are issued is usually too costly a procedure.

Accountants make adjusting entries for supplies on hand, like for any other prepaid expense, before preparing

financial statements. Supplies expense appears in the income statement. Supplies on hand is an asset in the balance

sheet.

Sometimes companies buy assets relating to insurance, rent, and supplies knowing that they will use them up

before the end of the current accounting period (usually one month or one year). If so, an expense account is

usually debited at the time of purchase rather than debiting an asset account. This procedure avoids having to make

an adjusting entry at the end of the accounting period. Sometimes, too, a company debits an expense even though

the asset will benefit more than the current period. Then, at the end of the accounting period, the firm’s adjusting

entry transfers some of the cost from the expense to the asset. For instance, assume that on January 1, a company

paid USD 1,200 rent to cover a three-year period and debited the USD 1,200 to Rent Expense. At the end of the

125