Page 161 - Accounting Principles (A Business Perspective)

P. 161

This book is licensed under a Creative Commons Attribution 3.0 License

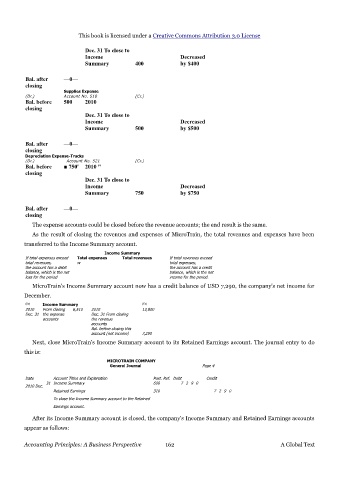

Dec. 31 To close to

Income Decreased

Summary 400 by $400

Bal. after —0—

closing

Supplies Expense

(Dr.) Account No. 518 (Cr.)

Bal. before 500 2010

closing

Dec. 31 To close to

Income Decreased

Summary 500 by $500

Bal. after —0—

closing

Depreciation Expense-Trucks

(Dr.) Account No. 521 (Cr.)

Bal. before ■ 750' 2010 "

closing

Dec. 31 To close to

Income Decreased

Summary 750 by $750

Bal. after —0—

closing

The expense accounts could be closed before the revenue accounts; the end result is the same.

As the result of closing the revenues and expenses of MicroTrain, the total revenues and expenses have been

transferred to the Income Summary account.

Income Summary

If total expenses exceed Total expenses Total revenues If total revenues exceed

total revenues, w total expenses,

the account has a debit the account has a credit

balance, which is the net balance, which is the net

loss for the period income for the period.

MicroTrain's Income Summary account now has a credit balance of USD 7,290, the company's net income for

December.

(Dr) Income Summary (Cr.)

2010 From closing 6,510 2010 13,800

Dec. 31 the expense Dec. 31 From closing

accounts the revenue

accounts

Bal. before closing this

account (net income) 7,290

Next, close MicroTrain's Income Summary account to its Retained Earnings account. The journal entry to do

this is:

MICROTRAIN COMPANY

General Journal Page 4

Date Account Titles and Explanation Post. Ref. Debt Credit

31 Income Summary 600 7 2 9 0

2010 Dec.

Retained Earnings 310 7 2 9 0

To close the Income Summary account to the Retained

Earnings account.

After its Income Summary account is closed, the company's Income Summary and Retained Earnings accounts

appear as follows:

Accounting Principles: A Business Perspective 162 A Global Text