Page 177 - Accounting Principles (A Business Perspective)

P. 177

This book is licensed under a Creative Commons Attribution 3.0 License

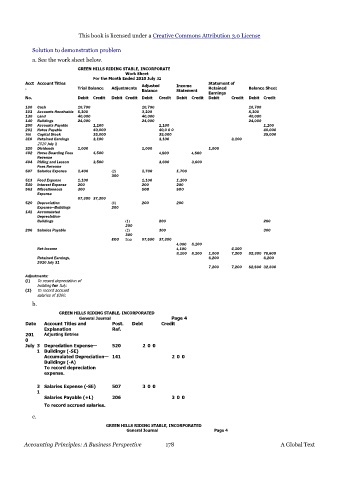

Solution to demonstration problem

a. See the work sheet below.

GREEN HILLS RIDING STABLE, INCORPORATE

Work Sheet

For the Month Ended 2010 July 31

Acct Account Titles Adjusted Income Statement of

. Trial Balance Adjustments Retained Balance Sheet

Balance Statement

Earnings

No. Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

100 Cash 10,700 10,700 10,700

103 Accounts Receivable S,100 3,100 8,100

130 Land 40,000 40,000 40,000

140 Buildings 24,000 24,000 24,000

200 Accounts Payable 1,100 1,100 1,100

201 Notes Payable 40,000 40,0 0 0 40,000

300 Capital Stock 35,000 35,000 35,000

310 Retained Earnings 3,100 3,100 3,100

2010 July 1

320 Dividends 1,000 1,000 1,000

402 Horse Boarding Fees 4,500 4,500 4,500

Revenue

404 Riding and Lesson 3,500 3,600 3,600

Fees Revenue

507 Salaries Expense 1,400 (2) 1,700 1,700

300

513 Feed Expense 1,100 1,100 1,100

540 Interest Expense 200 200 200

563 Miscellaneous 300 SOO SOO

Expense

87,300 37,300

520 Depreciation (1) 200 200

Expense—Buildings 200

141 Accumulated

Depreciation-

Buildings (1) 200 200

200

206 Salaries Payable (2) 300 300

300

EOO 5oo 87,500 37,300

4,000 8,100

Net Income 4,100 4,100

8,100 8,100 1,000 7,200 82,300 76,600

Retained Earnings, 6,200 6,200

2010 July 31

7,200 7,200 S2,S00 32,800

Adjustments:

(i) To record depreciation of

building for July.

(2) To record accrued

salaries of $300.

b.

GREEN HILLS RIDING STABLE, INCORPORATED

General Journal Page 4

Date Account Titles and Post. Debt Credit

Explanation Ref.

201 Adjusting Entries

0

July 3 Depredation Expense— 520 2 0 0

1 Buildings (-SE)

Accumulated Depreciation— 141 2 0 0

Buildings (-A)

To record depreciation

expense.

3 Salaries Expense (-SE) 507 3 0 0

1

Salaries Payable (+L) 206 3 0 0

To record accrued salaries.

c.

GREEN HILLS RIDING STABLE, INCORPORATED

General Journal Page 4

Accounting Principles: A Business Perspective 178 A Global Text