Page 183 - Accounting Principles (A Business Perspective)

P. 183

This book is licensed under a Creative Commons Attribution 3.0 License

400,000; and credit, USD 300,000. What was the probable cause of this difference? If this was not the cause, what

should he do to find the error?

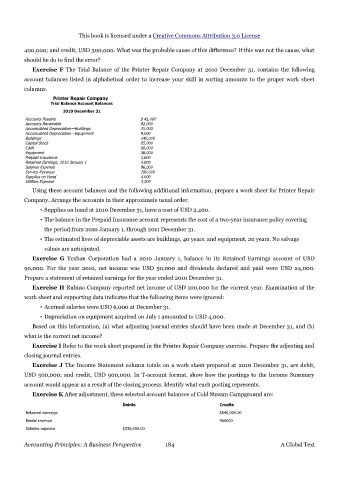

Exercise F The Trial Balance of the Printer Repair Company at 2010 December 31, contains the following

account balances listed in alphabetical order to increase your skill in sorting amounts to the proper work sheet

columns.

Printer Repair Company

Trial Balance Account Balances

2010 December 31

Accounts Payable $ 41,000

Accounts Receivable 92,000

Accumulated Depreciation—Buildings 25,000

Accumulated Depreciation—Equipment 9,000

Buildings 140,000

Capital Stock 65,000

Cash 60,000

Equipment 36,000

Prepaid Insurance 3,600

Retained Earnings, 2010 January 1 4,800

Salaries Expense 96,000

Service Revenue 290,000

Supplies on Hand 4,000

Utilities Expense 3,200

Using these account balances and the following additional information, prepare a work sheet for Printer Repair

Company. Arrange the accounts in their approximate usual order.

• Supplies on hand at 2010 December 31, have a cost of USD 2,400.

• The balance in the Prepaid Insurance account represents the cost of a two-year insurance policy covering

the period from 2010 January 1, through 2011 December 31.

• The estimated lives of depreciable assets are buildings, 40 years, and equipment, 20 years. No salvage

values are anticipated.

Exercise G Texban Corporation had a 2010 January 1, balance in its Retained Earnings account of USD

90,000. For the year 2010, net income was USD 50,000 and dividends declared and paid were USD 24,000.

Prepare a statement of retained earnings for the year ended 2010 December 31.

Exercise H Rubino Company reported net income of USD 100,000 for the current year. Examination of the

work sheet and supporting data indicates that the following items were ignored:

• Accrued salaries were USD 6,000 at December 31.

• Depreciation on equipment acquired on July 1 amounted to USD 4,000.

Based on this information, (a) what adjusting journal entries should have been made at December 31, and (b)

what is the correct net income?

Exercise I Refer to the work sheet prepared in the Printer Repair Company exercise. Prepare the adjusting and

closing journal entries.

Exercise J The Income Statement column totals on a work sheet prepared at 2010 December 31, are debit,

USD 500,000; and credit, USD 900,000. In T-account format, show how the postings to the Income Summary

account would appear as a result of the closing process. Identify what each posting represents.

Exercise K After adjustment, these selected account balances of Cold Stream Campground are:

Debits Credits

Retained earnings $540,000.00

Rental revenue 960000

Salaries expense $336,000.00

Accounting Principles: A Business Perspective 184 A Global Text