Page 206 - Accounting Principles (A Business Perspective)

P. 206

5. Accounting theory

Revenue recognition on long-term construction projects Companies recognize revenue from a long-

term construction project under two different methods: (1) the completed-contract method or (2) the percentage-

of-completion method. The completed-contract method does not recognize any revenue until the project is

completed. In that period, they recognize all revenue even though the contract may have required three years to

complete. Thus, the completed-contract method recognizes revenues at the time of sale, as is true for most sales

transactions. Companies carry costs incurred on the project forward in an inventory account (Construction in

Process) and charge them to expense in the period in which the revenue is recognized.

Some accountants argue that waiting so long to recognize any revenue is unreasonable. They believe that

because revenue-producing activities have been performed during each year of construction, revenue should be

recognized in each year of construction even if estimates are needed. The percentage-of-completion method

recognizes revenue based on the estimated stage of completion of a long-term project. To measure the stage of

completion, firms compare actual costs incurred in a period with the total estimated costs to be incurred on the

project.

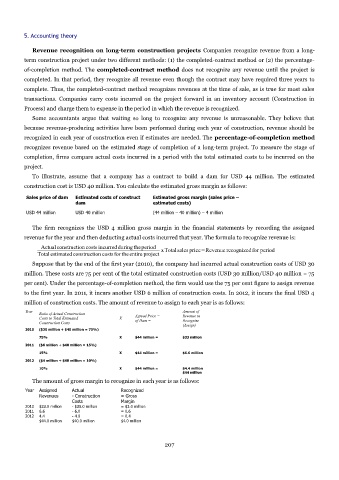

To illustrate, assume that a company has a contract to build a dam for USD 44 million. The estimated

construction cost is USD 40 million. You calculate the estimated gross margin as follows:

Sales price of dam Estimated costs of construct Estimated gross margin (sales price –

dam estimated costs)

USD 44 million USD 40 million (44 million – 40 million) – 4 million

The firm recognizes the USD 4 million gross margin in the financial statements by recording the assigned

revenue for the year and then deducting actual costs incurred that year. The formula to recognize revenue is:

Actualconstruction costs incurredduring theperiod xTotal sales price=Revenue recognizedfor period

Total estimated construction costsfor theentire project

Suppose that by the end of the first year (2010), the company had incurred actual construction costs of USD 30

million. These costs are 75 per cent of the total estimated construction costs (USD 30 million/USD 40 million = 75

per cent). Under the percentage-of-completion method, the firm would use the 75 per cent figure to assign revenue

to the first year. In 2011, it incurs another USD 6 million of construction costs. In 2012, it incurs the final USD 4

million of construction costs. The amount of revenue to assign to each year is as follows:

Year Amount of

Ratio of Actual Construction Agreed Price = Revenue to

Costs to Total Estimated X of Dam = Recognize

Construction Costs

(Assign)

2010 ($30 million + $40 million = 75%)

75% X $44 million = $33 million

2011 ($6 million + $40 million = 15%)

15% X $44 million = $6.6 million

2012 ($4 million + $40 million = 10%)

10% X $44 million = $4.4 million

$44 million

The amount of gross margin to recognize in each year is as follows:

Year Assigned Actual Recognized

Revenues - Construction = Gross

Costs Margin

2010 $33.0 million - $30.0 million = $3.0 million

2011 6.6 - 6.0 = 0.6

2012 4.4 - 4.0 = 0.4

$44.0 million $40.0 million $4.0 million

207