Page 221 - Accounting Principles (A Business Perspective)

P. 221

5. Accounting theory

• To a large extent, accounting theory determines the nature of those policies.

Demonstration problem

For each of the following transactions or circumstances and the entries made, state which, if any, of the

assumptions, concepts, principles, or modifying conventions of accounting have been violated. For each violation,

give the entry to correct the improper accounting assuming the books have not been closed.

During the year, Dorsey Company did the following:

• Had its buildings appraised. They were found to have a market value of USD 410,000, although their book

value was only USD 380,000. The accountant debited the Buildings and Accumulated Depreciation—Buildings

accounts for USD 15,000 each and credited Paid-in Capital—From Appreciation. No separate mention was

made of this action in the financial statements.

• Purchased new electric pencil sharpeners for its offices at a total cost of USD 60. These pencil sharpeners

were recorded as assets and are being depreciated over five years.

Solution to demonstration problem

• The cost principle and the modifying convention of conservatism may have been violated. Such write-ups

simply are not looked on with favor in accounting. To correct the situation, the entry made needs to be

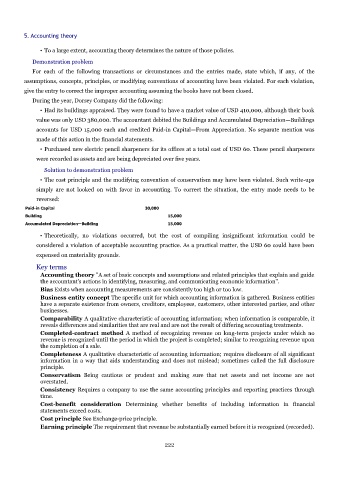

reversed:

Paid-in Capital 30,000

Building 15,000

Accumulated Depreciation—Building 15,000

• Theoretically, no violations occurred, but the cost of compiling insignificant information could be

considered a violation of acceptable accounting practice. As a practical matter, the USD 60 could have been

expensed on materiality grounds.

Key terms

Accounting theory "A set of basic concepts and assumptions and related principles that explain and guide

the accountant's actions in identifying, measuring, and communicating economic information".

Bias Exists when accounting measurements are consistently too high or too low.

Business entity concept The specific unit for which accounting information is gathered. Business entities

have a separate existence from owners, creditors, employees, customers, other interested parties, and other

businesses.

Comparability A qualitative characteristic of accounting information; when information is comparable, it

reveals differences and similarities that are real and are not the result of differing accounting treatments.

Completed-contract method A method of recognizing revenue on long-term projects under which no

revenue is recognized until the period in which the project is completed; similar to recognizing revenue upon

the completion of a sale.

Completeness A qualitative characteristic of accounting information; requires disclosure of all significant

information in a way that aids understanding and does not mislead; sometimes called the full disclosure

principle.

Conservatism Being cautious or prudent and making sure that net assets and net income are not

overstated.

Consistency Requires a company to use the same accounting principles and reporting practices through

time.

Cost-benefit consideration Determining whether benefits of including information in financial

statements exceed costs.

Cost principle See Exchange-price principle.

Earning principle The requirement that revenue be substantially earned before it is recognized (recorded).

222