Page 223 - Accounting Principles (A Business Perspective)

P. 223

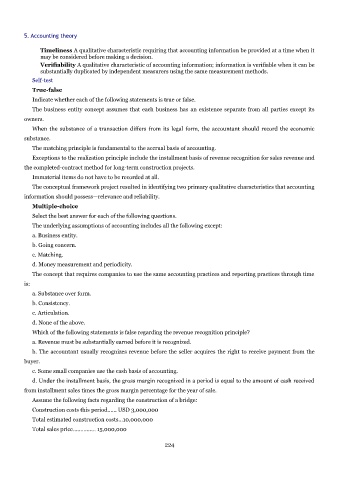

5. Accounting theory

Timeliness A qualitative characteristic requiring that accounting information be provided at a time when it

may be considered before making a decision.

Verifiability A qualitative characteristic of accounting information; information is verifiable when it can be

substantially duplicated by independent measurers using the same measurement methods.

Self-test

True-false

Indicate whether each of the following statements is true or false.

The business entity concept assumes that each business has an existence separate from all parties except its

owners.

When the substance of a transaction differs from its legal form, the accountant should record the economic

substance.

The matching principle is fundamental to the accrual basis of accounting.

Exceptions to the realization principle include the installment basis of revenue recognition for sales revenue and

the completed-contract method for long-term construction projects.

Immaterial items do not have to be recorded at all.

The conceptual framework project resulted in identifying two primary qualitative characteristics that accounting

information should possess—relevance and reliability.

Multiple-choice

Select the best answer for each of the following questions.

The underlying assumptions of accounting includes all the following except:

a. Business entity.

b. Going concern.

c. Matching.

d. Money measurement and periodicity.

The concept that requires companies to use the same accounting practices and reporting practices through time

is:

a. Substance over form.

b. Consistency.

c. Articulation.

d. None of the above.

Which of the following statements is false regarding the revenue recognition principle?

a. Revenue must be substantially earned before it is recognized.

b. The accountant usually recognizes revenue before the seller acquires the right to receive payment from the

buyer.

c. Some small companies use the cash basis of accounting.

d. Under the installment basis, the gross margin recognized in a period is equal to the amount of cash received

from installment sales times the gross margin percentage for the year of sale.

Assume the following facts regarding the construction of a bridge:

Construction costs this period...... USD 3,000,000

Total estimated construction costs...10,000,000

Total sales price............... 15,000,000

224