Page 277 - Accounting Principles (A Business Perspective)

P. 277

This book is licensed under a Creative Commons Attribution 3.0 License

False. Consigned goods delivered to another party for attempted sale are included in the ending inventory of

the company that sent the goods.

False. An unclassified income statement, not a classified income statement, has only two categories of items.

Multiple-choice

d. Trade discounts are not recorded on the books of either a buyer or a seller. In other words, the invoice price of

sales (purchases) is recorded: USD 4,000 X0.8=USD3,200

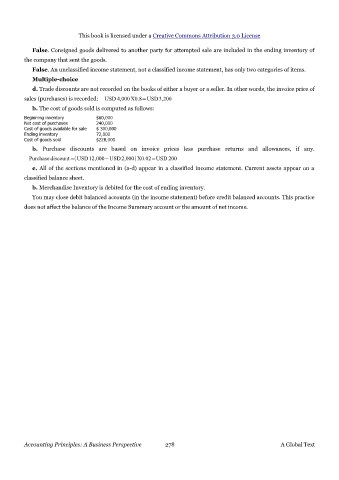

b. The cost of goods sold is computed as follows:

Beginning inventory $60,000

Net cost of purchases 240,000

Cost of goods available for sale $ 300,000

Ending inventory 72,000

Cost of goods sold $228,000

b. Purchase discounts are based on invoice prices less purchase returns and allowances, if any.

Purchase discount=USD12,000−USD2,000X0.02=USD 200

e. All of the sections mentioned in (a-d) appear in a classified income statement. Current assets appear on a

classified balance sheet.

b. Merchandise Inventory is debited for the cost of ending inventory.

You may close debit balanced accounts (in the income statement) before credit balanced accounts. This practice

does not affect the balance of the Income Summary account or the amount of net income.

Accounting Principles: A Business Perspective 278 A Global Text