Page 305 - Accounting Principles (A Business Perspective)

P. 305

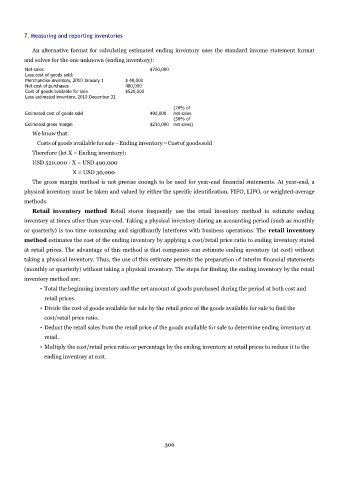

7. Measuring and reporting inventories

An alternative format for calculating estimated ending inventory uses the standard income statement format

and solves for the one unknown (ending inventory):

Net sales $700,000

Less cost of goods sold:

Merchandise inventory, 2010 January 1 $ 40,000

Net cost of purchases 480,000

Cost of goods available for sale $520,000

Less estimated inventory, 2010 December 31

(70% of

Estimated cost of goods sold 490,000 net sales

(30% of

Estimated gross margin $210,000 net sales)

We know that:

Costs of goods availableforsale−Ending inventory=Costof goodssold

Therefore (let X = Ending inventory):

USD 520,000 - X = USD 490,000

X = USD 30,000

The gross margin method is not precise enough to be used for year-end financial statements. At year-end, a

physical inventory must be taken and valued by either the specific identification, FIFO, LIFO, or weighted-average

methods.

Retail inventory method Retail stores frequently use the retail inventory method to estimate ending

inventory at times other than year-end. Taking a physical inventory during an accounting period (such as monthly

or quarterly) is too time consuming and significantly interferes with business operations. The retail inventory

method estimates the cost of the ending inventory by applying a cost/retail price ratio to ending inventory stated

at retail prices. The advantage of this method is that companies can estimate ending inventory (at cost) without

taking a physical inventory. Thus, the use of this estimate permits the preparation of interim financial statements

(monthly or quarterly) without taking a physical inventory. The steps for finding the ending inventory by the retail

inventory method are:

• Total the beginning inventory and the net amount of goods purchased during the period at both cost and

retail prices.

• Divide the cost of goods available for sale by the retail price of the goods available for sale to find the

cost/retail price ratio.

• Deduct the retail sales from the retail price of the goods available for sale to determine ending inventory at

retail.

• Multiply the cost/retail price ratio or percentage by the ending inventory at retail prices to reduce it to the

ending inventory at cost.

306