Page 572 - Accounting Principles (A Business Perspective)

P. 572

This book is licensed under a Creative Commons Attribution 3.0 License

• S Company owes P Company USD 5,000 on a note at December 31.

• Including its share (100 per cent) of S Company's income, P Company earned USD 31,000 during 2010.

• P. Company paid a cash dividend of USD 10,000 during December 2010.

• P Company uses the equity method of accounting for its investment in S Company.

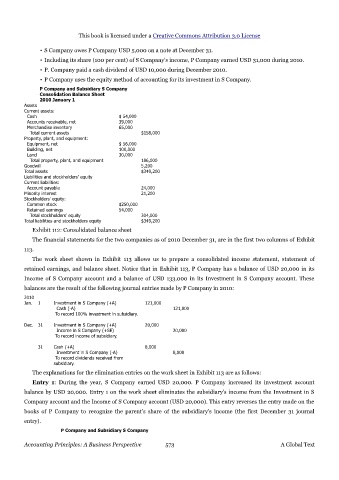

P Company and Subsidiary S Company

Consolidation Balance Sheet

2010 January 1

Assets

Current assets:

Cash $ 54,000

Accounts receivable, net 39,000

Merchandise inventory 65,000

Total current assets $158,000

Property, plant, and equipment:

Equipment, net $ 56,000

Building, net 100,000

Land 30,000

Total property, plant, and equipment 186,000

Goodwill 5,200

Total assets $349,200

Liabilities and stockholders' equity

Current liabilities:

Account payable 24,000

Minority interest 21,200

Stockholders' equity:

Common stock $250,000

Retained earnings 54,000

Total stockholders' equity 304,000

Total liabilities and stockholders equity $349,200

Exhibit 112: Consolidated balance sheet

The financial statements for the two companies as of 2010 December 31, are in the first two columns of Exhibit

113.

The work sheet shown in Exhibit 113 allows us to prepare a consolidated income statement, statement of

retained earnings, and balance sheet. Notice that in Exhibit 113, P Company has a balance of USD 20,000 in its

Income of S Company account and a balance of USD 133,000 in its Investment in S Company account. These

balances are the result of the following journal entries made by P Company in 2010:

2010

Jan. 1 Investment in S Company (+A) 121,000

Cash (-A) 121,000

To record 100% investment in subsidiary.

Dec. 31 Investment in S Company (+A) 20,000

Income in S Company (+SE) 20,000

To record income of subsidiary.

31 Cash (+A) 8,000

Investment in S Company (-A) 8,000

To record dividends received from

subsidiary.

The explanations for the elimination entries on the work sheet in Exhibit 113 are as follows:

Entry 1: During the year, S Company earned USD 20,000. P Company increased its investment account

balance by USD 20,000. Entry 1 on the work sheet eliminates the subsidiary's income from the Investment in S

Company account and the Income of S Company account (USD 20,000). This entry reverses the entry made on the

books of P Company to recognize the parent's share of the subsidiary's income (the first December 31 journal

entry).

P Company and Subsidiary S Company

Accounting Principles: A Business Perspective 573 A Global Text