Page 733 - Accounting Principles (A Business Perspective)

P. 733

This book is licensed under a Creative Commons Attribution 3.0 License

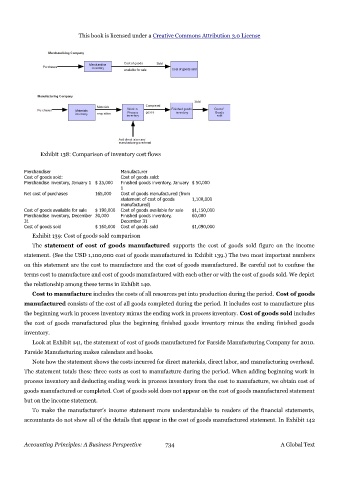

Exhibit 138: Comparison of inventory cost flows

Merchandiser Manufacturer

Cost of goods sold: Cost of goods sold:

Merchandise inventory, January 1 $ 25,000 Finished goods inventory, January $ 50,000

1

Net cost of purchases 165,000 Cost of goods manufactured (from

statement of cost of goods 1,100,000

manufactured)

Cost of goods available for sale $ 190,000 Cost of goods available for sale $1,150,000

Merchandise inventory, December 30,000 Finished goods inventory, 60,000

31 December 31

Cost of goods sold $ 160,000 Cost of goods sold $1,090,000

Exhibit 139: Cost of goods sold comparison

The statement of cost of goods manufactured supports the cost of goods sold figure on the income

statement. (See the USD 1,100,000 cost of goods manufactured in Exhibit 139.) The two most important numbers

on this statement are the cost to manufacture and the cost of goods manufactured. Be careful not to confuse the

terms cost to manufacture and cost of goods manufactured with each other or with the cost of goods sold. We depict

the relationship among these terms in Exhibit 140.

Cost to manufacture includes the costs of all resources put into production during the period. Cost of goods

manufactured consists of the cost of all goods completed during the period. It includes cost to manufacture plus

the beginning work in process inventory minus the ending work in process inventory. Cost of goods sold includes

the cost of goods manufactured plus the beginning finished goods inventory minus the ending finished goods

inventory.

Look at Exhibit 141, the statement of cost of goods manufactured for Farside Manufacturing Company for 2010.

Farside Manufacturing makes calendars and books.

Note how the statement shows the costs incurred for direct materials, direct labor, and manufacturing overhead.

The statement totals these three costs as cost to manufacture during the period. When adding beginning work in

process inventory and deducting ending work in process inventory from the cost to manufacture, we obtain cost of

goods manufactured or completed. Cost of goods sold does not appear on the cost of goods manufactured statement

but on the income statement.

To make the manufacturer's income statement more understandable to readers of the financial statements,

accountants do not show all of the details that appear in the cost of goods manufactured statement. In Exhibit 142

Accounting Principles: A Business Perspective 734 A Global Text