Page 734 - Accounting Principles (A Business Perspective)

P. 734

18. Managerial accounting concepts/job costing

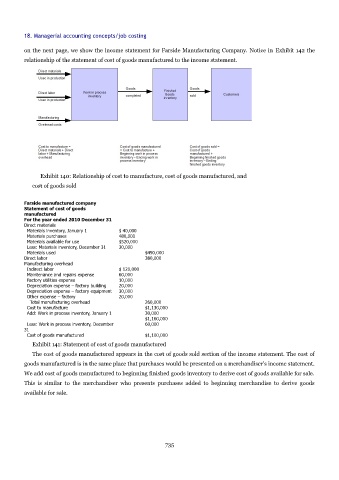

on the next page, we show the income statement for Farside Manufacturing Company. Notice in Exhibit 142 the

relationship of the statement of cost of goods manufactured to the income statement.

Exhibit 140: Relationship of cost to manufacture, cost of goods manufactured, and

cost of goods sold

Farside manufactured company

Statement of cost of goods

manufactured

For the year ended 2010 December 31

Direct materials

Materials inventory, January 1 $ 40,000

Materials purchases 480,000

Materials available for use $520,000

Less: Materials inventory, December 31 30,000

Materials used $490,000

Direct labor 380,000

Manufacturing overhead

Indirect labor $ 120,000

Maintenance and repairs expense 60,000

Factory utilities expense 10,000

Depreciation expense – factory building 20,000

Depreciation expense – factory equipment 30,000

Other expense – factory 20,000

Total manufacturing overhead 260,000

Cost to manufacture $1,130,000

Add: Work in process inventory, January 1 30,000

$1,160,000

Less: Work in process inventory, December 60,000

31

Cost of goods manufactured $1,100,000

Exhibit 141: Statement of cost of goods manufactured

The cost of goods manufactured appears in the cost of goods sold section of the income statement. The cost of

goods manufactured is in the same place that purchases would be presented on a merchandiser's income statement.

We add cost of goods manufactured to beginning finished goods inventory to derive cost of goods available for sale.

This is similar to the merchandiser who presents purchases added to beginning merchandise to derive goods

available for sale.

735