Page 97 - Accounting Principles (A Business Perspective)

P. 97

2. Recording business transactions

100 Cash 320 Dividends

103 Accounts Receivable 402 Horse Boarding Fees Revenue

130 Land 404 Riding and Lesson Fees Revenue

140 Buildings 507 Salaries Expense

200 Accounts Payable 513 Feed Expense

201 Notes Payable 540 Interest Expense

300 Capital Stock 568 Miscellaneous Expense

310 Retained Earnings

c. Prepare a trial balance.

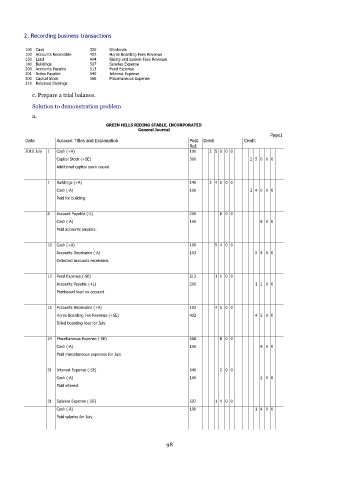

Solution to demonstration problem

a.

GREEN HILLS RIDING STABLE, INCORPORATED

General Journal

Page1

Date Account Titles and Explanation Post. Debit Credit

Ref.

2010 July 1 Cash (+A) 100 2 5 0 0 0

Capital Stock (+SE) 300 2 5 0 0 0

Additional capital stock issued.

1 Buildings (+A) 140 2 4 0 0 0

Cash (-A) 100 2 4 0 0 0

Paid for building.

8 Account Payable (-L) 200 8 0 0

Cash (-A) 100 8 0 0

Paid accounts payable.

10 Cash (+A) 100 5 4 0 0

Accounts Receivable (-A) 103 5 4 0 0

Collected accounts receivable.

12 Feed Expense (-SE) 513 1 1 0 0

Accounts Payable (+L) 200 1 1 0 0

Purchased feed on account

15 Accounts Receivable (+A) 103 4 5 0 0

Horse Boarding Fee Revenue (+SE) 402 4 5 0 0

Billed boarding fees for July.

24 Miscellaneous Expense (-SE) 568 8 0 0

Cash (-A) 100 8 0 0

Paid miscellaneous expenses for July.

31 Interest Expense (-SE) 540 2 0 0

Cash (-A) 100 2 0 0

Paid interest

31 Salaries Expense (-SE) 507 1 4 0 0

Cash (-A) 100 1 4 0 0

Paid salaries for July.

98