Page 99 - Accounting Principles (A Business Perspective)

P. 99

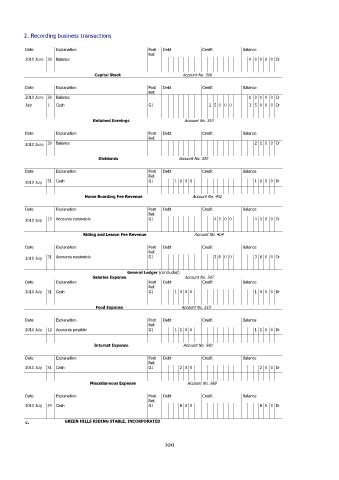

2. Recording business transactions

Date Explanation Post Debt Credit Balance

Ref.

2010 June 30 Balance 4 0 0 0 0 Cr

Capital Stock Account No. 300

Date Explanation Post Debt Credit Balance

Ref.

2010 June 30 Balance 1 0 0 0 0 Cr

July 1 Cash G1 2 5 0 0 0 3 5 0 0 0 Cr

Retained Earnings Account No. 310

Date Explanation Post Debt Credit Balance

Ref.

2010 June 30 Balance 2 1 0 0 Cr

Dividends Account No. 320

Date Explanation Post Debt Credit Balance

Ref.

2010 July 31 Cash G1 1 0 0 0 1 0 0 0 Dr

Horse Boarding Fee Revenue Account No. 402

Date Explanation Post Debt Credit Balance

Ref.

2010 July 15 Accounts receivable G1 4 5 0 0 4 5 0 0 Cr

Riding and Lesson Fee Revenue Account No. 404

Date Explanation Post Debt Credit Balance

Ref.

2010 July 31 Accounts receivable G1 3 6 0 0 3 6 0 0 Cr

General Ledger (concluded)

Salaries Expense Account No. 507

Date Explanation Post Debt Credit Balance

Ref.

2010 July 31 Cash G1 1 4 0 0 1 4 0 0 Dr

Feed Expense Account No. 513

Date Explanation Post Debt Credit Balance

Ref.

2010 July 12 Accounts payable G1 1 1 0 0 1 1 0 0 Dr

Interest Expense Account No. 540

Date Explanation Post Debt Credit Balance

Ref.

2010 July 31 Cash G1 2 0 0 2 0 0 Dr

Miscellaneous Expense Account No. 568

Date Explanation Post Debt Credit Balance

Ref.

2010 July 24 Cash G1 8 0 0 8 0 0 Dr

c. GREEN HILLS RIDING STABLE, INCORPORATED

100