Page 4 - latest pb aia 30 - Copy

P. 4

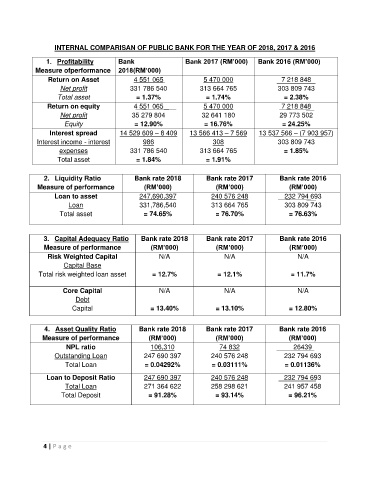

INTERNAL COMPARISAN OF PUBLIC BANK FOR THE YEAR OF 2018, 2017 & 2016

1. Profitability Bank Bank 2017 (RM’000) Bank 2016 (RM’000)

Measure ofperformance 2018(RM’000)

Return on Asset 4 551 065 5 470 000 7 218 848

Net profit 331 786 540 313 664 765 303 809 743

Total asset = 1.37% = 1.74% = 2.38%

Return on equity 4 551 065 5 470 000 7 218 848

Net profit 35 279 804 32 641 180 29 773 502

Equity = 12.90% = 16.76% = 24.25%

Interest spread 14 529 609 – 8 409 13 566 413 – 7 569 13 537 566 – (7 903 957)

Interest income - interest 986 308 303 809 743

expenses 331 786 540 313 664 765 = 1.85%

Total asset = 1.84% = 1.91%

2. Liquidity Ratio Bank rate 2018 Bank rate 2017 Bank rate 2016

Measure of performance (RM’000) (RM’000) (RM’000)

Loan to asset 247,690,397 240 576 248 232 794 693

Loan 331,786,540 313 664 765 303 809 743

Total asset = 74.65% = 76.70% = 76.63%

3. Capital Adequacy Ratio Bank rate 2018 Bank rate 2017 Bank rate 2016

Measure of performance (RM’000) (RM’000) (RM’000)

Risk Weighted Capital N/A N/A N/A

Capital Base

Total risk weighted loan asset = 12.7% = 12.1% = 11.7%

Core Capital N/A N/A N/A

Debt

Capital = 13.40% = 13.10% = 12.80%

4. Asset Quality Ratio Bank rate 2018 Bank rate 2017 Bank rate 2016

Measure of performance (RM’000) (RM’000) (RM’000)

NPL ratio 106,310 74 832 26439

Outstanding Loan 247 690 397 240 576 248 232 794 693

Total Loan = 0.04292% = 0.03111% = 0.01136%

Loan to Deposit Ratio 247 690 397 240 576 248 232 794 693

Total Loan 271 364 622 258 298 621 241 957 458

Total Deposit = 91.28% = 93.14% = 96.21%

4 | P a g e