Page 6 - latest pb aia 30 - Copy

P. 6

Return on equity (ROE) measures how effective a management is using a company’s

assets in making profits. ROE is considered as the return on net assets since shareholders' equity

is equal to a company’s assets minus its debt. ROE measures the profits made for each dollar

from shareholders’ equity. The chart above presents that the ROE of Public Bank in is a downward

trend from 2016 to 2018. The returns are 24.25%, 16.76% and 12.90% respective of the three

years. The declining return means that the bank’s management is making poor decisions on

reinvesting capital in unproductive assets. In order to enhance the ROE, Public Bank must be

able to raise their operating profit margins. Loans with higher return will offer better profit

opportunities. Through transactions and non-interest income activities, the bank can diversify its

earnings. Public Bank can also broaden its differentiated products, such as wealth management

and insurance to refine its ROE.

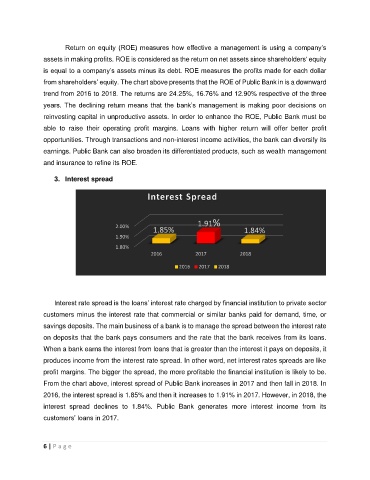

3. Interest spread

Interest Spread

1.91%

2.00%

1.85% 1.84%

1.90%

1.80%

2016 2017 2018

2016 2017 2018

Interest rate spread is the loans’ interest rate charged by financial institution to private sector

customers minus the interest rate that commercial or similar banks paid for demand, time, or

savings deposits. The main business of a bank is to manage the spread between the interest rate

on deposits that the bank pays consumers and the rate that the bank receives from its loans.

When a bank earns the interest from loans that is greater than the interest it pays on deposits, it

produces income from the interest rate spread. In other word, net interest rates spreads are like

profit margins. The bigger the spread, the more profitable the financial institution is likely to be.

From the chart above, interest spread of Public Bank increases in 2017 and then fall in 2018. In

2016, the interest spread is 1.85% and then it increases to 1.91% in 2017. However, in 2018, the

interest spread declines to 1.84%. Public Bank generates more interest income from its

customers’ loans in 2017.

6 | P a g e