Page 318 - Keys To Community College Success

P. 318

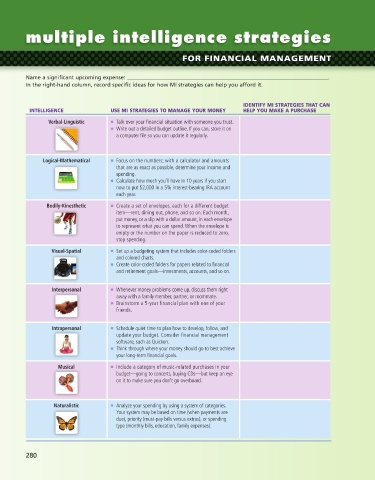

multiple intelligence strategies

FOR FINANCIAL MANAGEMENT

Name a significant upcoming expense: .

In the right-hand column, record specific ideas for how MI strategies can help you afford it.

IDENTIFY MI STRATEGIES THAT CAN

INTELLIGENCE USE MI STRATEGIES TO MANAGE YOUR MONEY HELP YOU MAKE A PURCHASE

Verbal-Linguistic ■ Talk over your financial situation with someone you trust.

■ Write out a detailed budget outline. If you can, store it on

a computer file so you can update it regularly.

Logical-Mathematical ■ Focus on the numbers; with a calculator and amounts

that are as exact as possible, determine your income and

spending.

■ Calculate how much you’ll have in 10 years if you start

now to put $2,000 in a 5% interest-bearing IRA account

each year.

Bodily-Kinesthetic ■ Create a set of envelopes, each for a different budget

item—rent, dining out, phone, and so on. Each month,

put money, or a slip with a dollar amount, in each envelope

to represent what you can spend. When the envelope is

empty or the number on the paper is reduced to zero,

stop spending.

Visual-Spatial ■ Set up a budgeting system that includes color-coded folders

and colored charts.

■ Create color-coded folders for papers related to financial

and retirement goals—investments, accounts, and so on.

Interpersonal ■ Whenever money problems come up, discuss them right

away with a family member, partner, or roommate.

■ Brainstorm a 5-year financial plan with one of your

friends.

Intrapersonal ■ Schedule quiet time to plan how to develop, follow, and

update your budget. Consider financial management

software, such as Quicken.

■ Think through where your money should go to best achieve

your long-term financial goals.

Musical ■ Include a category of music-related purchases in your

budget—going to concerts, buying CDs—but keep an eye

on it to make sure you don’t go overboard.

Naturalistic ■ Analyze your spending by using a system of categories.

Your system may be based on time (when payments are

due), priority (must-pay bills versus extras), or spending

type (monthly bills, education, family expenses).

280