Page 320 - Keys To Community College Success

P. 320

get practical

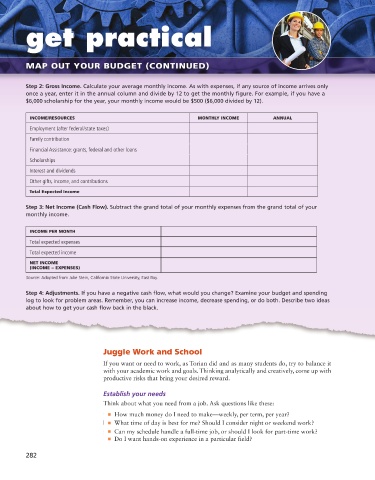

MAP OUT YOUR BUDGET (CONTINUED)

Step 2: Gross Income. Calculate your average monthly income. As with expenses, if any source of income arrives only

once a year, enter it in the annual column and divide by 12 to get the monthly figure. For example, if you have a

$6,000 scholarship for the year, your monthly income would be $500 ($6,000 divided by 12).

INCOME/RESOURCES MONTHLY INCOME ANNUAL

Employment (after federal/state taxes)

Family contribution

Financial Assistance: grants, federal and other loans

Scholarships

Interest and dividends

Other gifts, income, and contributions

Total Expected Income

Step 3: Net Income (Cash Flow). Subtract the grand total of your monthly expenses from the grand total of your

monthly income.

INCOME PER MONTH

Total expected expenses

Total expected income

NET INCOME

(INCOME − EXPENSES)

Source: Adapted from Julie Stein, California State University, East Bay.

Step 4: Adjustments. If you have a negative cash flow, what would you change? Examine your budget and spending

log to look for problem areas. Remember, you can increase income, decrease spending, or do both. Describe two ideas

about how to get your cash flow back in the black.

Juggle Work and School

If you want or need to work, as Torian did and as many students do, try to balance it

with your academic work and goals. Thinking analytically and creatively, come up with

productive risks that bring your desired reward.

Establish your needs

Think about what you need from a job. Ask questions like these:

■ How much money do I need to make—weekly, per term, per year?

■ What time of day is best for me? Should I consider night or weekend work?

■ Can my schedule handle a full-time job, or should I look for part-time work?

■ Do I want hands-on experience in a particular field?

282