Page 323 - Keys to College Success

P. 323

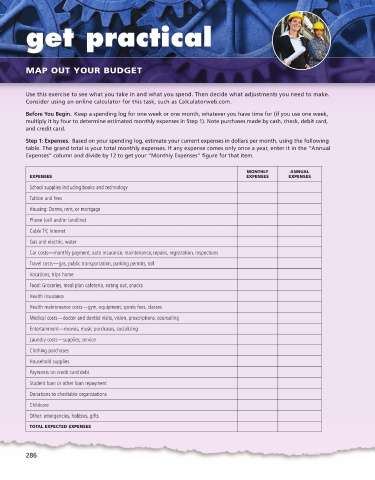

get practical

MAP OUT YOUR BUDGET

Use this exercise to see what you take in and what you spend. Then decide what adjustments you need to make.

Consider using an online calculator for this task, such as Calculatorweb.com.

Before You Begin. Keep a spending log for one week or one month, whatever you have time for (if you use one week,

multiply it by four to determine estimated monthly expenses in Step 1). Note purchases made by cash, check, debit card,

and credit card.

Step 1: Expenses. Based on your spending log, estimate your current expenses in dollars per month, using the following

table. The grand total is your total monthly expenses. If any expense comes only once a year, enter it in the “Annual

Expenses” column and divide by 12 to get your “Monthly Expenses” figure for that item.

MONTHLY ANNUAL

EXPENSES EXPENSES EXPENSES

School supplies including books and technology

Tuition and fees

Housing: Dorms, rent, or mortgage

Phone (cell and/or landline)

Cable TV, Internet

Gas and electric, water

Car costs—monthly payment, auto insurance, maintenance, repairs, registration, inspections

Travel costs—gas, public transportation, parking permits, toll

Vacations, trips home

Food: Groceries, meal plan cafeteria, eating out, snacks

Health insurance

Health maintenance costs—gym, equipment, sports fees, classes

Medical costs—doctor and dentist visits, vision, prescriptions, counseling

Entertainment—movies, music purchases, socializing

Laundry costs—supplies, service

Clothing purchases

Household supplies

Payments on credit card debt

Student loan or other loan repayment

Donations to charitable organizations

Childcare

Other: emergencies, hobbies, gifts

TOTAL EXPECTED EXPENSES

286