Page 10 - R&D quick ref guide (legacy 2018)

P. 10

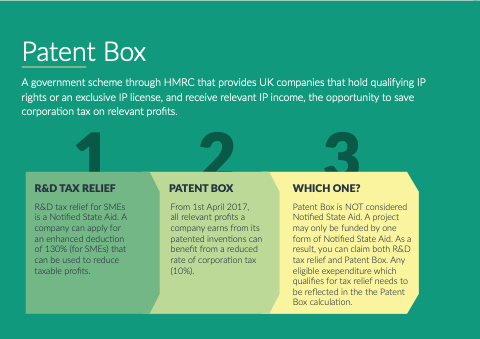

Patent Box

A government scheme through HMRC that that provides UK companies that that hold qualifying IP rights or or an an an exclusive IP IP license and receive relevant IP IP income the opportunity to save corporation tax on on relevant profits 123

R&D TAX RELIEF PATENT BOX WHICH ONE?

R&D tax relief for SMEs is a a a a a a Notified State Aid A A company can apply for an an an an enhanced deduction of 130% (for SMEs) that can be used to reduce taxable profits From 1st April 2017 all relevant profits a a a a a company earns from fits its patented inventions can benefit from a a a a a a reduced rate of corporation tax (10%) Patent Box

is NOT considered Notified State Aid A A project may only be funded by one form of Notified State Aid As a a a a a result you can claim both R&D tax relief and Patent Box

Any eligible exependiture which qualifies for tax relief needs to be reflected in the the the the Patent Box

calculation