Page 12 - R&D quick ref guide (legacy 2018)

P. 12

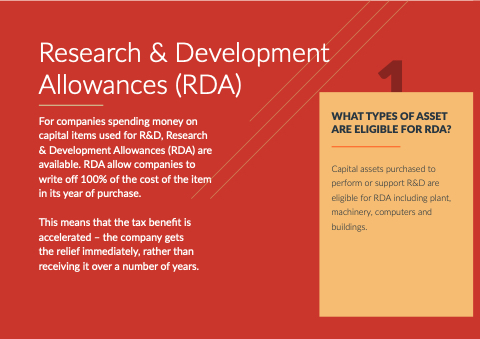

Research Research & & Development 1 Allowances (RDA)

For companies spending money on on capital items used for R&D Research & Development Allowances (RDA)

are available RDA allow companies to write off 100% o of of the the cost o of of the the item in its year of purchase This means that the tax benefit is is accelerated – the company gets the the relief immediately rather than receiving it over a a number of years WHAT TYPES OF ASSET ARE ELIGIBLE FOR RDA?

Capital assets purchased to perform or or or support R&D are eligible for RDA including plant machinery computers and buildings