Page 14 - R&D quick ref guide (legacy 2018)

P. 14

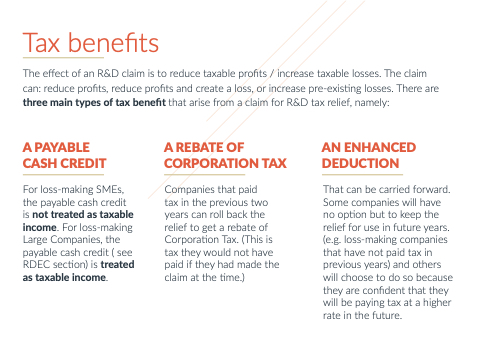

Tax benefits

The The effect of o an R&D claim claim is to reduce taxable taxable profits / increase taxable taxable losses The The claim claim can: reduce reduce profits profits reduce reduce profits profits and create a a a a a a loss loss or increase pre-existing losses There are three main types of tax tax benefit that arise from a a a a a a a a claim for R&D tax tax relief namely:

A A A A PAYABLE CASH CREDIT

For loss-making SMEs the payable cash credit is not treated as as taxable income For loss-making Large Companies the payable cash credit ( see RDEC section) is treated as taxable income A A A REBATE OF CORPORATION TAX

Companies that paid

tax in the the previous two years can roll back the the relief to get a a a a a a a rebate of Corporation Tax (This is is tax they they would not have paid

if they they had made the the the the claim at the the time ) AN AN ENHANCED DEDUCTION

That can be carried forward Some companies will have no option but to keep the relief for use in in future years (e g g loss-making companies that have not paid

tax in in previous years) and others will choose to do so because they they are confident that they they will be paying tax at at at a a a a a a a higher rate in in the future