Page 15 - R&D quick ref guide (legacy 2018)

P. 15

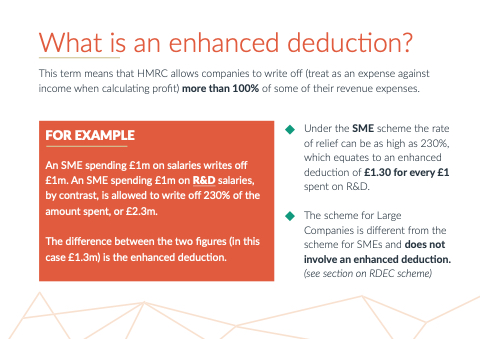

What is an an enhanced deduction?

This term means that HMRC allows companies to write off (treat as an an an expense against income when calculating profit) more than 100% o of of some o of of their revenue expenses Under the the SME scheme the the rate of relief can be as as high as as 230% which equates to an an enhanced deduction of £1 £1 30 for every £1 £1 spent on R&D The scheme for Large Companies is different from the scheme for SMEs and does not involve an an enhanced deduction (see section on on RDEC scheme)

FOR EXAMPLE

An SME spending £1m on salaries writes off £1m £1m An SME spending £1m £1m on R&D salaries by contrast is allowed to write off 230% o of the amount spent or £2 3m The difference between the two figures (in this case £1 3m) is the enhanced deduction