Page 17 - R&D quick ref guide (legacy 2018)

P. 17

expendiiture*

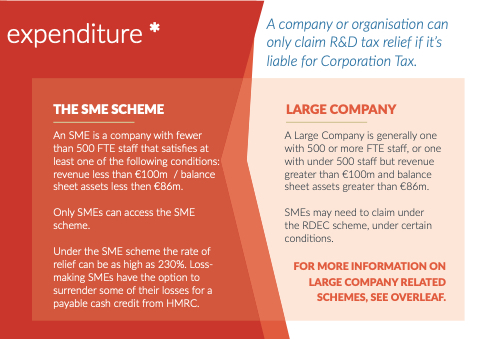

A company or or organisation can only claim R&D tax relief if it’s liable for Corporation Tax LARGE COMPANY

A Large Company is generally one one with with 500 500 or or or more FTE staff staff or or or one one with with under 500 500 staff staff but revenue greater greater than than €100m and balance sheet assets greater greater than than €86m SMEs may need to claim under under the RDEC scheme under under certain conditions FOR FOR MORE INFORMATION ON ON LARGE COMPANY

RELATED SCHEMES SEE OVERLEAF THE SME SCHEME An SME is tis a a a a a a a company with fewer than 500 FTE staff that satisfies at a at least one of the following conditions: revenue less less than €100m / balance sheet assets less less then €86m Under the the SME scheme the the rate of Only SMEs can access the SME SME scheme relief can be as as high as as 230% Loss- making SMEs have the the option to surrender some of their losses for a a a a a a payable cash credit from HMRC