Page 18 - R&D quick ref guide (legacy 2018)

P. 18

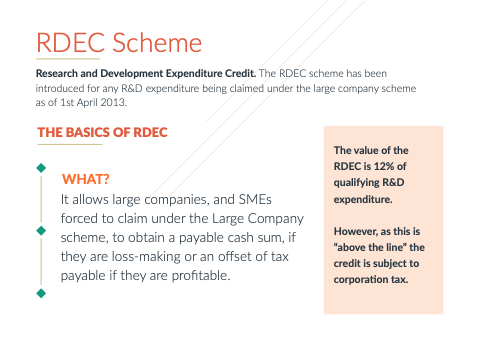

RDEC Scheme

Research and Development Expenditure Credit The RDEC scheme has been introduced for any any R&D expenditure being claimed under the large company scheme as of 1st April 2013 THE BASICS OF RDEC WHAT?

It allows large companies and SMEs forced to claim under the Large Company scheme to obtain a a a a a payable cash sum if they are loss-making or an offset o of tax payable if they are profitable The value of the RDEC is 12% of qualifying R&D expenditure However as this is is “above the the line” the the credit is subject to corporation tax