Page 19 - R&D quick ref guide (legacy 2018)

P. 19

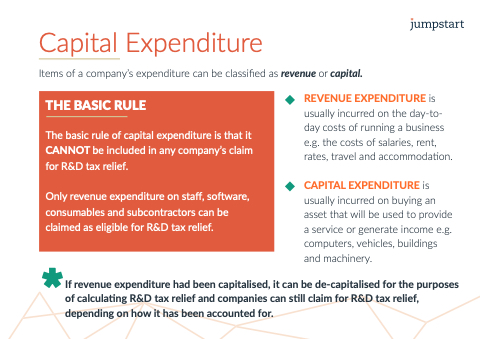

Capital Expenditure Items of a a a a a a a company’s expenditure can be classified as as revenue or capital REVENUE EXPENDITURE is usually incurred on the day-to- day costs of running a a business e e e e g the costs of salaries rent rates travel and accommodation CAPITAL EXPENDITURE is usually incurred on buying an asset that will be used to provide a a service or generate income e e e e e e e g g computers vehicles buildings and machinery If revenue expenditure had been capitalised capitalised it it it it can can be be de-capitalised for for the purposes

of calculating R&D R&D tax tax relief relief and companies can can still claim for for for R&D R&D tax tax relief relief depending on how it has been accounted for THE BASIC RULE

The basic rule of capital expenditure is that it it it CANNOT be included in in any any company’s claim for R&D tax relief Only revenue expenditure on staff software consumables and subcontractors can be claimed as eligible for R&D tax relief *