Page 21 - R&D quick ref guide (legacy 2018)

P. 21

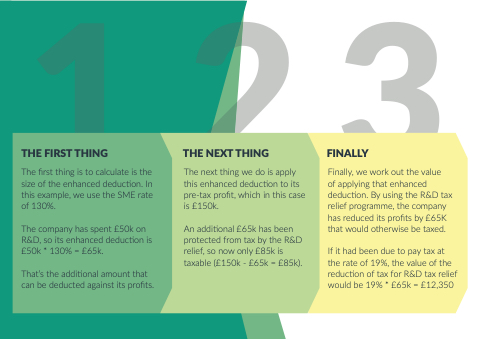

THE FIRST THING

The first thing is is to calculate is is the the size of the the the enhanced deduction In this example we use the the SME rate of 130% The company has spent £50k on on R&D so its enhanced deduction is £50k * 130% = £65k That’s the additional amount that can be deducted against its fits profits THE NEXT THING

The next thing we do is is apply this this enhanced deduction to its pre-tax profit which in this this case is £150k An additional £65k has been protected from tax by the R&D relief so now only £85k £85k is taxable (£150k - £65k = £85k) FINALLY

Finally we work out the value

of applying that enhanced deduction By using the the R&D tax relief programme the the company has reduced its fits profits by £65K that would otherwise be taxed If it had been due to pay tax at at the the the rate of of of 19% the the the value

of of of the the the reduction of of of tax tax for R&D tax tax relief would be 19% * £65k = £12 350