Page 23 - R&D quick ref guide (legacy 2018)

P. 23

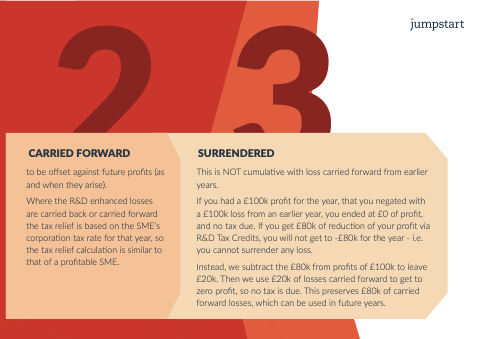

CARRIED FORWARD

to be offset against future profits (as and when they arise) Where the R&D enhanced losses

are carried carried back or or carried carried forward the the tax relief is based on the the SME’s corporation tax rate for that year so the tax relief calculation is similar to that of o a a a profitable SME SURRENDERED

This is is NOT cumulative with loss carried forward from earlier years If you you had a a a a a £100k profit for the year that you you negated with a a a a a £100k loss from an earlier year you ended at £0 of o profit and no tax due If you you get £80k of of o reduction of of o your profit via R&D Tax Credits you will not get to -£80k for the year - - i i i e e e e e you cannot surrender any loss Instead we subtract the £80k from profits o of £100k to leave £20k £20k Then we use £20k £20k of losses

carried forward to to get to to zero profit so no tax is is due This preserves £80k o of carried forward losses

which can be used in future years