Page 22 - R&D quick ref guide (legacy 2018)

P. 22

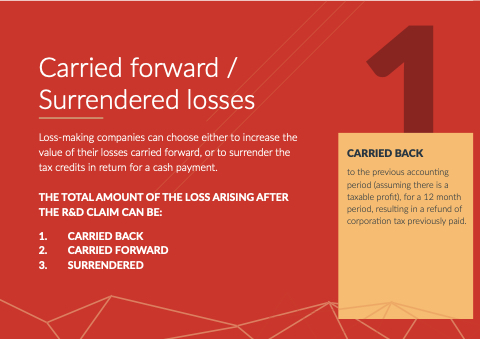

Carried forward /

Surrendered losses

Loss-making companies can choose either to increase the the value of their losses

carried forward or or to surrender the the tax credits in return for a a a a cash payment THE THE THE TOTAL AMOUNT OF THE THE THE LOSS ARISING AFTER THE THE R&D CLAIM CAN BE:

1 CARRIED CARRIED BACK

2 CARRIED CARRIED FORWARD

3 SURRENDERED

CARRIED BACK

to the previous accounting period (assuming there is a a taxable profit) for a a a 12 month period resulting tin in a refund of corporation tax previously paid