Page 24 - R&D quick ref guide (legacy 2018)

P. 24

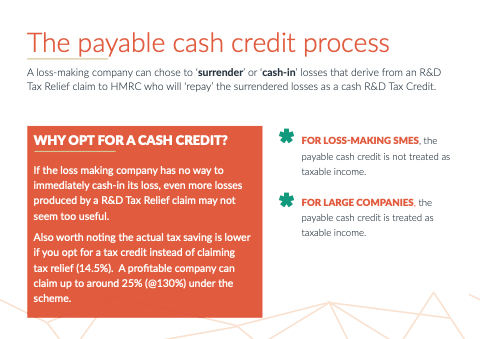

The payable cash credit process

A loss-making company can chose to ‘surrender’ or ‘cash-in’ losses that derive from an an an R&D Tax Tax Relief claim to HMRC who will ‘repay’ the surrendered losses as as a a a a a a a cash R&D Tax Tax Credit * FOR LOSS-MAKING SMES the payable cash credit is not treated as as taxable income * FOR LARGE COMPANIES the payable cash credit is treated as as taxable income WHY OPT FOR A A CASH CREDIT?

If the loss making company has no way to immediately cash-in its loss loss even more losses produced by a a a a R&D Tax Relief claim may not seem too useful Also worth noting the actual tax saving is lower if you opt for a a a a tax credit instead of claiming tax relief (14 5%) A profitable company can claim up to around 25% (@130%)

under the scheme