Page 18 - Q1_2024 Rosendin Corporate Newsletter

P. 18

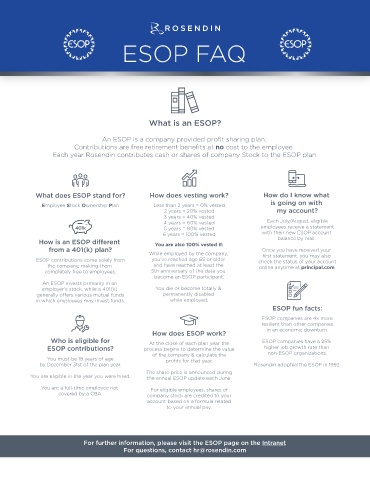

What is an ESOP?

no cost to the employee.

Each year Rosendin contributes cash or shares of company Stock to the ESOP plan.

What does ESOP stand for? How does vesting work? How do I know what

is going on with

Employee Stock Ownership Plan Less than 2 years = 0% vested

2 years = 20% vested my account?

3 years = 40% vested

4 years = 60% vested Each July/August, eligible

5 years = 80% vested employees receive a statement

6 years = 100% vested with their new ESOP account

balance by mail.

You are also 100% vested if:

from a 401(k) plan? Once you have received your

While employed by the company,

ESOP contributions come solely from you’ve reached age 65 or older check the status of your account

the company, making them and have reached at least the online anytime at principal.com.

completely free to employees. 5th anniversary of the date you

become an ESOP participant.

An ESOP invests primarily in an

employer’s stock, while a 401(k) You die or become totally &

permanently disabled

in which employees may invest funds. while employed.

ESOP fun facts:

ESOP companies are 4x more

resilient than other companies

How does ESOP work? in an economic downturn.

Who is eligible for At the close of each plan year the ESOP companies have a 25%

ESOP contributions? process begins to determine the value higher job growth rate than

of the company & calculate the non-ESOP organizations.

You must be 18 years of age

by December 31st of the plan year. Rosendin adopted the ESOP in 1992.

The share price is announced during

You are eligible in the year you were hired. the annual ESOP update each June.

You are a full-time employee not For eligible employees, shares of

covered by a CBA. company stock are credited to your

account based on a formula related

to your annual pay.

For further information, please visit the ESOP page on the Intranet

For questions, contact hr@rosendin.com