Page 9 - Strategy Flipbook v.2_Classical

P. 9

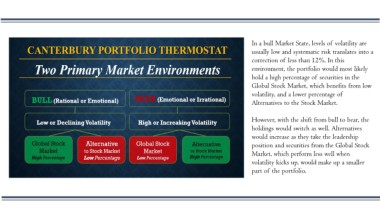

In a bull Market State, levels of volatility are

usually low and systematic risk translates into a

correction of less than 12%. In this

environment, the portfolio would most likely

hold a high percentage of securities in the

Global Stock Market, which benefits from low

volatility, and a lower percentage of

Alternatives to the Stock Market.

However, with the shift from bull to bear, the

holdings would switch as well. Alternatives

would increase as they take the leadership

position and securities from the Global Stock

Market, which perform less well when

volatility kicks up, would make up a smaller

part of the portfolio.