Page 116 - Ready Set Retire

P. 116

Stephen J. Kelley

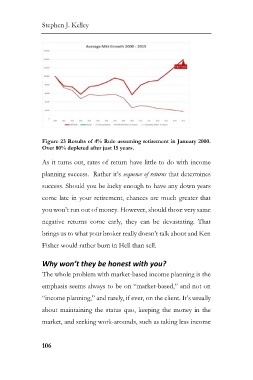

Figure 23 Results of 4% Rule assuming retirement in January 2000.

Over 80% depleted after just 15 years.

As it turns out, rates of return have little to do with income

planning success. Rather it’s sequence of returns that determines

success. Should you be lucky enough to have any down years

come late in your retirement, chances are much greater that

you won’t run out of money. However, should those very same

negative returns come early, they can be devastating. That

brings us to what your broker really doesn’t talk about and Ken

Fisher would rather burn in Hell than sell.

Why won’t they be honest with you?

The whole problem with market-based income planning is the

emphasis seems always to be on “market-based,” and not on

“income planning,” and rarely, if ever, on the client. It’s usually

about maintaining the status quo, keeping the money in the

market, and seeking work-arounds, such as taking less income

106