Page 22 - Know-So Money, Hope-So Money, Retirement Secrets Wall Street Doesn't Want You to Know

P. 22

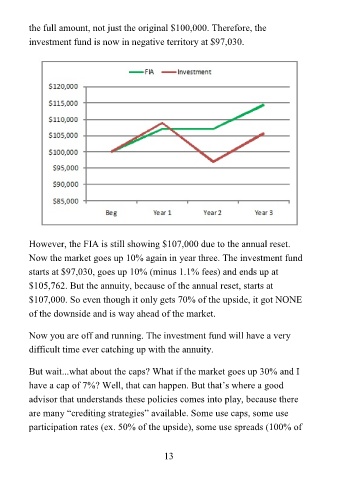

the full amount, not just the original $100,000. Therefore, the

investment fund is now in negative territory at $97,030.

However, the FIA is still showing $107,000 due to the annual reset.

Now the market goes up 10% again in year three. The investment fund

starts at $97,030, goes up 10% (minus 1.1% fees) and ends up at

$105,762. But the annuity, because of the annual reset, starts at

$107,000. So even though it only gets 70% of the upside, it got NONE

of the downside and is way ahead of the market.

Now you are off and running. The investment fund will have a very

difficult time ever catching up with the annuity.

But wait...what about the caps? What if the market goes up 30% and I

have a cap of 7%? Well, that can happen. But that’s where a good

advisor that understands these policies comes into play, because there

are many “crediting strategies” available. Some use caps, some use

participation rates (ex. 50% of the upside), some use spreads (100% of

13