Page 24 - 25148.pdf

P. 24

12 • The 100 Greatest Ideas for Building the Business of your Dreams

businessman realised immediately, was that taking his salary out of the costs of his

original business and transferring it to the new entity put him half way to achieving

the profit growth target at a stroke. Neat eh?

Now consider this. When you are dealing with a large organisation with a view

to taking one of their less prosperous bits off their hands, you are looking at it as

TICK- think in cash, knucklehead Idea 55. However, the manager of the bit you are

buying is thinking in terms of his or her management accounting system. In most

big organisations, for example, head office does not allow that its own costs, which

are apportioned to the divisions, must make some sort of contribution or be cut.

Here is what happens if head office believes that its costs are inevitable and fixed.

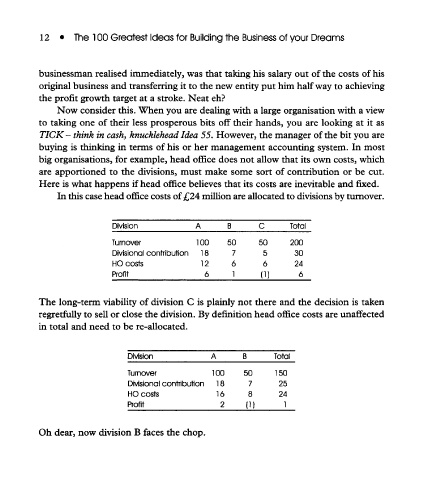

In this case head office costs of £24 million are allocated to divisions by turnover.

Division A B C Total

Turnover 1 00 50 50 200

Divisional contribution 18 7 5 30

HO costs 12 6 6 24

Profit 6 1 (1) 6

The long-term viability of division C is plainly not there and the decision is taken

regretfully to sell or close the division. By definition head office costs are unaffected

in total and need to be re-allocated.

Division A B Total

Turnover 1 00 50 150

Divisional contribution 18 7 25

HO costs 16 8 24

Profit 2 (1)

1

Oh dear, now division B faces the chop.